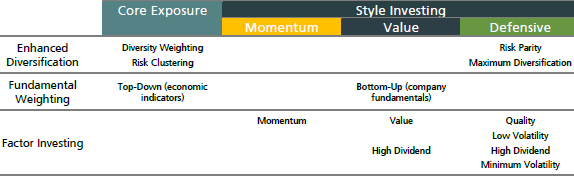

What kinds of smart beta work best? In their January 2016 paper entitled “A Taxonomy of Beta Based on Investment Outcomes”, Sanne De Boer, Michael LaBella and Sarah Reifsteck compare and contrast smart beta (simple, transparent, rules-based) strategies via backtesting of 12 long-only smart beta stock portfolios. They assign these portfolios to a framework that translates diversification, fundamental weighting and factor investing into core equity exposure and style investing (see the figure below). They constrain backtests to long-only positions, relatively investable/liquid stocks and quarterly rebalancing, treating developed and emerging markets separately. Backtest outputs address gross performance, benchmark tracking accuracy and portfolio turnover. Using beta-related data for developed market stocks during 1979 through 2014 and emerging market stocks during 2001 through 2014, they find that:

- Core portfolios have the: (1) widest breadth across stocks, countries and sectors; (2) lowest tracking errors, with risk about the same as the capitalization-weighted market; and, (3) lowest turnover.

- Overall, style investing portfolios outperform the core group. Momentum is most volatile, and value has the worst drawdowns. Except for risk parity and fundamental weighting, style portfolios tend to have narrow breadth.

- However, the best core strategy (risk clustering, which groups countries/sectors by risk similarity) outperforms both value and momentum on a gross risk-adjusted basis in both developed and emerging markets, perhaps because long-only portfolios do not efficiently access style premiums.

- The defensive group has the best absolute and risk-adjusted gross performance, with relatively low volatility and small drawdowns, likely benefiting from a secular interest rate decline over the sample period that favors bond-like stocks.

- The momentum portfolio has particularly high turnover, as do the two optimized defensive portfolios (maximum diversification and low volatility).

The following chart, taken from the paper, translates 12 smart beta portfolios from objectives (enhanced diversification, fundamental weighting and factor investing) into investment outcomes (core equity exposure and style investing). Appendix A in the paper summarizes portfolio specifications.

In summary, evidence from backtests suggests that each smart beta stock portfolio has merits but most involve style or country/sector concentrations that carry risk of large performance swings.

Cautions regarding findings include:

- As noted in the paper, backtested returns do not account for trading frictions, management fees or taxes. Since these costs may vary by portfolio, net findings may differ from gross findings.

- As noted in the paper, portfolio formation rules/parameter values may involve data snooping (“benefit from the use of hindsight”), thereby overstating expectations.

- The paper examines equity only. Diversification to other asset classes may affect attractiveness of the 12 smart beta portfolios.