Is value of a firm’s patents a reliable predictor of its stock returns? In their November 2018 paper entitled “Patent-to-Market Premium”, Jiaping Qiu, Kevin Tseng and Chao Zhang investigate firm patent-to-market (PTM) ratio (percentage of market value attributable to patents) as a predictor of stock returns. They specify PTM ratio for each firm as follows:

- Measure stock reaction to each patent grant date.

- Depreciate each patent since grant date via an inventory depreciation method.

- Estimate cumulative market value of all patents held by adding current depreciated values.

- Divide cumulative patent value by firm market value.

They then at the end of June each year reform a hedge portfolio that is long (short) the tenth, or decile, of stocks with the highest (lowest) PTM ratios. Using market and lagged accounting data for a broad sample of U.S. common stocks/firms and intersecting patent data (5,475 distinct firms) during 1965 through 2010, they find that:

- Average PTM ratio increases from 6.9% in 1965 to 13.6% in 2010, indicating that intellectual property grows in importance. Firms with high PTM ratios tend to have relatively high research and development expenditures and low asset growth, concentrating within industries such as chemicals, electronic equipment and computers.

- Over the full sample period, the equal-weighted (value-weighted) extreme decile PTM ratio hedge portfolio generates average monthly gross return 0.71% (0.48%), with 4-factor (market, size, book-to-market, momentum) 0.69% (0.33%).

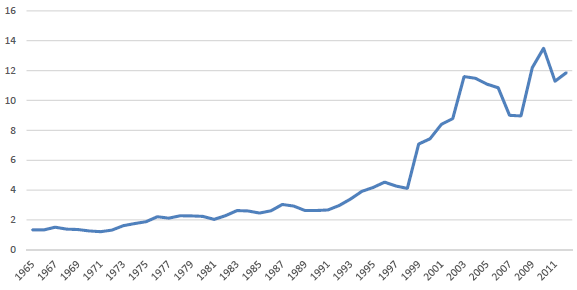

- The value-weighted extreme decile PTM ratio hedge portfolio exhibits fairly steady growth over the sample period and often does not track broad market drawdowns (see the chart below).

- PTM ratio relates positively associated to firm profitability starting two years hence.

- Findings are robust to controlling for a broad set of market and accounting variables.

The following chart, taken from the paper, shows cumulative return of the value-weighted extreme decile PTM ratio hedge portfolio over the full sample period. Results are fairly consistent, although the late 2000s drawdown is substantial.

In summary, evidence indicates that market-determined and depreciated aggregate value of firm patents may usefully predict stock returns.

Cautions regarding findings include:

- The newest data used are eight years stale.

- Reported results are gross, not net. Trading frictions associated with annual portfolio reformation would reduce returns, probably more for the equal-weighted than the value-weighted approach. Costs of shorting would also reduce returns, and shorting may not always be feasible as specified due to lack of shares to borrow.

- PTM ratio portfolio construction is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

- There may be inherited data snooping bias in the approach to evaluating and depreciating patents, though the paper states that results are robust to varying associated parameters.