Do stock dividends exhibit exploitable risk premiums? In their July 2018 paper entitled “A Model-Free Term Structure of U.S. Dividend Premiums”, Maxim Ulrich, Stephan Florig and Christian Wuchte construct a term structure of the dividend risk premium and test strategies to time this premium at specific horizons. They specify dividend risk premium as the spread between:

- Expected dividend growth rate based on analyst 1-year and 2-year S&P 500 dividend forecasts, extended by analyst 5-year earnings growth estimates assuming constant future payout ratio.

- Expected dividend growth rate derived from equity index put and call option prices across different maturities.

They model an S&P 500 dividend capture portfolio for a given horizon as: long an S&P 500 Index put option of maturity matching the horizon; short an index call option of same maturity and strike price; long the index; and, short the money market in an amount matched to the option strike price. They test two strategies for capturing this premium at a 12-month horizon: (1) each month (last trading day) reform and hold the dividend capture portfolio; or, (2) each month reform and hold the dividend capture portfolio only when the dividend risk premium is positive (analyst-estimated dividends are higher than options-implied dividends). They model the risk-free rate/money market rate across horizons using the U.S. Dollar Overnight Index Swap rate for one day to 10 years. For the S&P 500 Index, they assume annual expense ratio 0.07% and 0.01% average bid-ask spread. For options, they estimate trading frictions with actual bid-ask spreads. Using S&P 500 Index/options and analyst forecast data as specified during January 2004 through October 2017, they find that:

- The dividend risk premium is zero for immediate dividends, increasing for dividends over the next 13 months and decreasing thereafter.

- Strategy 1 above generates gross (net) annualized Sharpe ratio 1.19 (0.01) over the full sample period, compared to 0.36 for buying and holding the S&P 500 Index.

- Strategy 2 above generates gross (net) annualized Sharpe ratio 1.41 (0.80) over the full sample period, indicating substantial value from timing based on the dividend risk premium. Returns are positively skewed and have negative market beta, implying value as a hedge.

- Fama-French market, size, book-to-market, profitability and investment factors do not explain the performance of the dividend capture strategies.

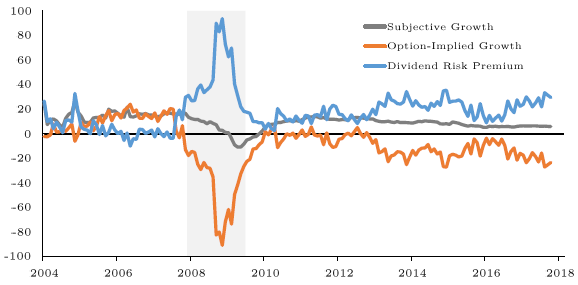

The following chart, taken from the paper, tracks the S&P 500 Index dividend growth rate based on analyst forecasts (Subjective Growth) and based on option prices (Option-Implied Growth) at a 12-month horizon. It also shows the dividend risk premium (difference between expected growth rates). Notable points are:

- The dividend risk premium is mostly positive.

- The 2008-2009 financial crisis had a dramatic effect on options behavior and the dividend risk premium.

In summary, evidence indicates that investors may be able to generate material alpha via a 1-year dividend capture portfolio active only when the dividend risk premium is positive.

Cautions regarding findings include:

- The approach outlined is beyond the reach of most investors, who would bear fees for delegating the work to a fund manager.

- It appears that the strategies tested are sensitive to the levels of associated trading frictions. Investors may not be able to achieve the assumed levels.

- The sample period is not long in terms of variety of market/economic conditions. Moreover, per the chart above, the dividend capture timing strategy (strategy 2 above) generates few trades and apparently no trades after late 2007. This result suggests that outperformance of this strategy may relate to rare market conditions.

- The overall dividend risk premium model/dividend capture strategy is complex enough to raise concerns about model/parameter snooping bias and overstated expectations.