Should investors consider allocations to products that track equity volatility indexes? In her July 2019 paper entitled “Challenges of Indexation in S&P 500 Index Volatility Investment Strategies”, Margaret Sundberg examines whether behaviors of S&P 500 Index option-based volatility indexes justify treatment of volatility as an asset class. To assess potential strategies, she employs the following indexes:

- S&P 500 Index

- S&P 500 Total Return Index

- S&P 500 Option-implied volatility index (VIX)

- S&P 500 VIX Short-Term Futures Index

- S&P 500 VIX Short-Term Futures Inverse Index

- S&P 500 Iron Condor Index

- S&P 500 PutWrite Index

Using daily time series for these indexes during April 2008 through March 2019, she finds that:

- Over the sample period, gross compound annual growth rates (CAGR) are:

- 9.5% for the S&P 500 Total Return Index, with annual volatility 11.8%.

- -48.7% for the S&P 500 VIX Short-Term Futures Index, with annual volatility 68.6%.

- -0.2% for the S&P 500 VIX Short-Term Futures Inverse Index, with annual volatility 119%.

- 0.3% for the S&P 500 Iron Condor Index, with annual volatility 7.6%.

- 5.8% for the S&P 500 PutWrite Index, with annual volatility 14.0%.

- 1.8% for a daily rebalanced position in the S&P 500 VIX Short-Term Futures Index (allocation 16%) retrospectively sized to hedge the S&P 500 Total Return Index (allocation 84%) during the 2008 financial crisis, with annual volatility 11.8%.

- Cycles of fear and greed drive abnormalities (such as fat tails and asymmetry between left and right tails) in S&P 500 Index returns that conflict with option and option-implied volatility index return model assumptions.

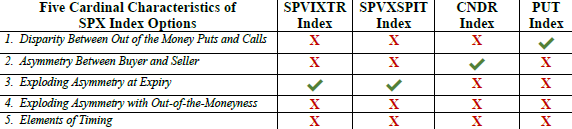

- Five important, but mostly ignored, points for designing equity index option strategies are (see the table below):

- Out-of-the-money calls and puts behave differently, likely due to different supply-demand dynamics.

- Asymmetric return distributions can make surprise losses extremely large compared to surprise gains.

- Conflicts between real-world return distributions and those assumed for option models escalate as time to expiration shrinks.

- These conflicts also escalate with option out-of-the-moneyness.

- Equity index return autocorrelation and volatility persistence argue for timing of option exposure.

The following table, taken from the paper, summarizes which of the five important points for designing equity index option strategies are reflected by each of four option-implied volatility indexes:

- SPVIXTR – S&P 500 VIX Short-Term Futures

- SPVXSPIT – S&P 500 VIX Short-Term Futures Inverse

- CNDR – S&P 500 Iron Condor

- PUT – S&P 500 PutWrite

No volatility index reflects more than one of the five points.

In summary, evidence indicates that investors should not use strategies based on products tracking widely used S&P 500 Index option-implied volatility indexes.

Cautions regarding findings include:

- The sample period is short for analysis of annualized outcomes.

- Reported returns are for indexes, not tradable assets. Accounting for costs of maintaining liquid tracking funds would reduce reported returns.

- Findings may differ for options on indexes for other asset classes.