What is the historical relationship between U.S. stock market earnings yield (E/P) and U.S. government bond yield (Y)? In their February 2018 paper entitled “Stock Earnings and Bond Yields in the US 1871 – 2016: The Story of a Changing Relationship”, Valeriy Zakamulin and Arngrim Hunnes examine the relationship between E/P Y over the long run, with focus on structural breaks, causes of breaks and direction of causality. They employ a vector error correction model that allows multiple structural breaks. In assessing causes of breaks, they consider inflation, income taxes and Federal Reserve Bank monetary policy. Using quarterly S&P Composite Index level, index earnings, long-term government bond yield and inflation data during 1871 through 2016, along with contemporaneous income tax rates and Federal Reserve monetary actions, they find that:

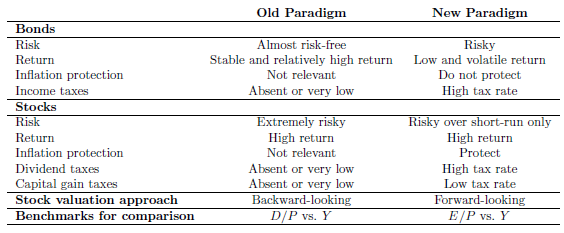

- There are three regimes during the sample period, two with stable relationships between E/P and Y (see the table below) and one with no relationship:

- During 1871-1929, there is a reasonably stable E/P=2Y regime.

- During 1930-1957, there is no stable relationship between E/P and Y.

- During 1958-2016, there is a reasonably stable E/P=Y regime (the Fed Model).

- Conditions during Regime 1 included moderate inflation, low or no income taxes and nearly risk-free corporate bonds. The dominant stock valuation approach was comparison of past dividend yield to bond yield.

- The transition from Regime 1 to Regime 2 derives from expansionary U.S. monetary policy after the 1929 stock market crash and ensuing depression, lowering the short-term interest rate to near zero.

- The transition from Regime 2 to Regime 3 derives from a change in stock valuation theory in response to increased riskiness of corporate bonds, inflation relatively high compared to bond yield and income tax on bond coupons higher than that on long-term capital gains for stocks. In concert, firms began replacing dividends with share repurchases. The approach to stock valuation changed to comparison of potential future dividend yield (E/P) to bond yield.

- When there are stable relationships during 1871-1929 and 1958-2016, causality tests indicate that Y leads E/P over both short and long horizons, but not vice versa. This leading role of Y implies that stock prices increase (decrease) after the Federal Reserve lowers (raises) interest rates.

- Recently:

- Visual inspection (but not statistical analysis) suggests a potential regime change in 2010 with near zero interest rates. The resulting uncertainty in stock valuation may introduce equity market turbulence.

- Since the early 2000s, the U.S. government lowered dividend taxes to approximate parity with the stock capital gains tax rate, driving a substantial positive correlation between stock dividends and prices. Resurgent importance of dividends may flip Regime 3 back to Regime 1.

The following table, taken from the paper, summarizes old (Regime 1) and new (Regime 3) stock valuation approaches, with the dividend yield (D/P) roughly equal to ½E/P during Regime 1.

In summary, evidence indicates that the competition between stock earnings yield and bond yield is a dynamic function of bond coupon reliability, inflation, relative tax rates and level of short-term interest rates. Changes in these conditions may change how investors evaluate stocks.

Cautions regarding findings include:

- Source data includes some estimated/extrapolated values and is somewhat blurred because monthly values are averages of daily values across the month. This blurriness is of minor concern for long run analyses.

- The paper is retrospective, offering no evidence of regime predictability or exploitability via some stocks-bonds timing strategy.

See also: