Do differences in expectations between institutional and individual investors in stocks and bonds, as quantified in weekly legacy Commitments of Traders (COT) reports, offer exploitable timing signals? In the February 2019 revision of his paper entitled “Want Smart Beta? Follow the Smart Money: Market and Factor Timing Using Relative Sentiment”, flagged by a subscriber, Raymond Micaletti tests a U.S. stock market-U.S. bond market timing strategy based on an indicator derived from aggregate equity and Treasuries positions of institutional investors (COT Commercials) relative to individual investors (COT Non-reportables). This Smart Money Indicator (SMI) has three relative sentiment components, each quantified weekly based on differences in z-scores between standalone institutional and individual net COT positions, with z-scores calculated over a specified lookback interval:

- Maximum weekly relative sentiment for the S&P 500 Index over a second specified lookback interval.

- Negative weekly minimum relative sentiment in the 30-Year U.S. Treasury bond over this second lookback interval.

- Difference between weekly maximum relative sentiments in the 10-Year U.S. Treasury note and 30-year U.S. Treasury bond over this second lookback interval.

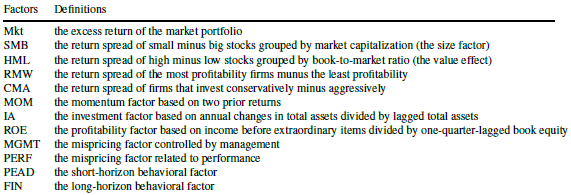

Final SMI is the sum of these components minus median SMI over the second specified lookback interval. He considers z-score calculation lookback intervals of 39, 52, 65, 78, 91 and 104 weeks and maximum/minimum relative sentiment lookback intervals of one to 13 weeks (78 lookback interval combinations). For baseline results, he splices futures-only COT data through March 14, 1995 with futures-and-options COT starting March 21, 1995. To account for changing COT reporting delays, he imposes a baseline one-week lag for using COT data in predictions. He focuses on the ability of SMI to predict the market factor, but also looks at its ability to enhance: (1) intrinsic (time series or absolute) market factor momentum; and, (2) returns for size, value, momentum, profitability, investment, long-term reversion, short-term reversal, low volatility and quality equity factors. Finally, he compares to several benchmarks the performance of an implementable strategy that invests in the broad U.S. stock market (U.S. Aggregate Bond Total Return Index) when a group of SMI substrategies “vote” positively (negatively). Using weekly legacy COT reports and daily returns for the specified factors/indexes during October 1992 through December 2017, he finds that: Keep Reading