Why have so many quantitative funds performed poorly in recent years? In his January 2021 paper entitled “The Quant Crisis of 2018-2020: Cornered by Big Growth”, David Blitz examines in detail recent (June 2018 through August 2020) performance of stock portfolios constructed from five widely accepted long-short factors:

- Size – Small Minus Big (SMB) market capitalizations.

- Value – High Minus Low (HML) book-to-market ratios.

- Investment – Conservative Minus Aggressive (CMA).

- Profitability – Robust Minus Weak (RMW).

- Momentum – Winners Minus Losers (WML).

Using factor returns from the Kenneth French data library and additional firm/stock data for developed and U.S. markets to construct alternative factor performance tests from various start dates through August 2020, he finds that:

- The only way to outperform during June 2018 through August 2020 is holding the largest and most expensive (lowest book-to-market ratio) growth stocks.

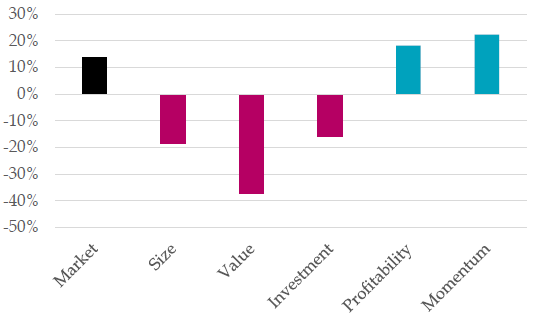

- Factor portfolios fail or succeed during this time to the extent they hold these same large growth stocks (see the chart below):

- Small stocks broadly underperform.

- Value is the worst performer.

- Profitability and momentum are successful because they gravitate toward large growth.

- This is the first time that value factor underperformance is the dominant market theme. This time, momentum gains are not nearly large enough to compensate for value losses, and there are no offsetting small-stock opportunities.

- However, underperformance of quantitative investing during June 2018 through August 2020 appears well within the distribution of reasonably expected outcomes, driven by unsustainable multiple expansion of growth stocks. Evidence implies neither a structural break nor sudden disappearance of factor premiums that have existed for decades.

The following chart, taken from the paper, compares cumulative gross factor performance during June 2018 through August 2020. Solid performances by profitability and momentum factors are not large enough to offset the weak performances by size, investment and (especially) value factors.

In summary, June 2018 through August 2020 represents an exceptional challenge to quantitative investing, but also an episode from which quantitative investment strategies can be expected to recover.

Cautions regarding findings include:

- As implied by the conclusion, the June 2018 through August 2020 subperiod is extremely short for inference about future factor performance.

- Factor premiums are gross, not net. Accounting for costs of periodic factor portfolio reformation and shorting costs/constraints would reduce all returns, differently for different factors.