Is the conventional wisdom that exchange-traded funds (ETF) are efficient, low-cost alternatives to mutual funds correct? In their September 2019 paper entitled “The Performance of Exchange-Traded Funds”, David Blitz and Milan Vidojevic evaluate the performance of a comprehensive, survivorship bias-free sample of U.S. equity ETFs. They first divide the sample into three groups: (1) broad market index trackers; (2) inverse and leveraged funds; and, (3) others. They then subdivide group 3 into equity factor subgroups (small, value, dividend, momentum, quality or low-risk) based on either their names or their empirical exposures to widely accepted factor premiums. Finally, they compare performances of value-weighted ETF groups to those of the broad U.S. stock market and specified factors, focusing on data starting January 2004 when there are at least 100 ETFs of some variety. Using trading data and descriptions for 918 U.S. equity ETFs (642 live and 276 dead by the end of the sample period) and equity factor returns during January 1993 through December 2017, they find that:

- Collectively, ETFs underperform the stock market by an amount similar to mutual fund underperformance. On a fund-by-fund basis, 60% have lower returns than the market, 80% have higher volatility and 80% have lower Sharpe ratios.

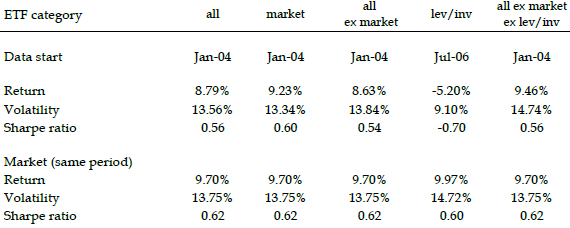

- During 2004-2017 (see the table below), based on value-weighted groupings:

- The full sample of ETFs lags the market by 0.91% per year, with annual Sharpe ratio 0.56 versus 0.62 for the market.

- Broad market index ETFs lag the market by 0.47% per year, but with lower volatility and Sharpe ratio 0.60.

- Leveraged/inverse ETFs (since July 2006), dramatically underperform the market with negative return and Sharpe ratio.

- “Other” ETFs lag the market by 0.24% per year, with Sharpe ratio 0.56.

- All factor subgroups except low-risk (available only since mid-2011) have lower Sharpe ratios than the market and negative 1-factor (market) and multi-factor alphas. Magnitudes of alphas are similar to those for actively managed mutual funds.

- Results are similar for equal-weighted ETF groups, and for limiting the weight of any one ETF to 10% or 15% and distributing the excess proportionally across all other ETFs in the portfolio.

The following table, excerpted from the paper, compares performances of five value-weighted groups (categories) of U.S. equity ETFs to that of the broad U.S. stock market over matched sample periods. The five groups are:

- all – the full sample of ETFs.

- market – the few ETFs that track a broad U.S. equity market index.

- all ex market – all ETFs not in group 2.

- lev/inv – all leveraged and inverse ETFs.

- all ex market ex lev/inv – the “other” group specified above, including all factor ETFs.

Results show that ETF groups generally underperform the market. However, the market portfolio bears no costs of rebalancing to accommodate additions and deletions or of maintaining liquidity for redemptions.

In summary, available evidence offers little support for belief that ETFs are superior to similar mutual funds for long-term investors.

Cautions regarding findings include:

- As noted by the authors, short sample periods limit statistical significance of results.

- Investors can trade ETFs, but not mutual funds, intraday. The authors argue that “continuous trading…should be of little relevance to passive investors…”

- As noted by the authors, market and factor returns ignore costs of maintaining liquid portfolios (which may be considerable for some factors), but the industry/academia evaluates mutual funds the same way.

- As noted by the authors, ETF factor exposures often vary over time.

- The study addresses only U.S. equity ETFs.