Do global equity funds generate alpha after accounting for both equity and currency factors? In their October 2016 paper entitled “Global Equity Fund Performance Evaluation with Equity and Currency Style Factors”, David Gallagher, Graham Harman, Camille Schmidt and Geoff Warren measure the performance of global equity funds based on their quarterly holdings after adjusting for market return, six widely used equity factor returns and three widely used currency exchange factor returns. The six equity factors are size (market capitalization), value (average of book-to-market and cash flow-to-price ratios), momentum (return from 12 months ago to one month ago in local currency), investment (quarterly change in total assets), profitability (return-on-equity) and illiquidity (impact of trading). The three currency exchange factors are trend (3-month average exchange rate minus 12-month average exchange rate), carry (reflecting short-term interest rate differences) and value (based on deviation from purchasing power parity). They also test developed and emerging markets holdings of these funds separately. Using quarterly stock holding weights for 90 institutional global equity funds priced in U.S. dollars, and contemporaneous equity and currency exchange factor return data, during 2002 through 2012, they find that:

- The sample of funds holds stocks from 43 different countries, encompassing 33 currencies. The number of funds increases from an average of 12 in 2002 to 63 in 2012. The number of stocks held is relatively stable, ranging from 120 to 195.

- Market-adjusted return of the sample (relative to the MSCI All Country World Index (ACWI)

or the MSCI World Index) is 0.19% per quarter. - All six equity factors and all three currency factors help explain performance of global equity funds.

- Five of six equity factors have significant return premiums. Momentum does not, largely due to large negative returns during 2009.

- Carry and value currency exchange factors exhibit significant return premiums (negative and positive, respectively).

- Global equity funds:

- Tilt on average toward large stocks (relative to local markets), profitable stocks, low-momentum stocks, stocks from countries with low interest rates and overvalued currencies.

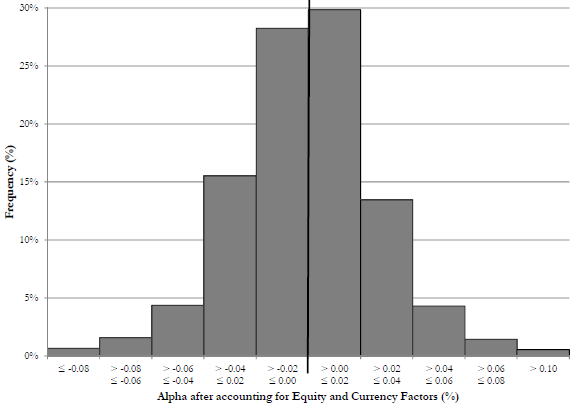

- Exhibit no stock-picking skill overall, with average quarterly 9-factor alpha -0.18% (see the chart below for the distribution).

- Exhibit (but without statistical significance) stock-picking skill in emerging markets, with average quarterly 9-factor alpha 1.04%.

- Generate significantly negative (insignificantly positive) alpha when tilted toward high value, low momentum and low profitability (oppositely).

- Results suggest that investors could capture outperforming factors like value more reliably via mechanical (smart beta) funds than via active funds.

The following chart, taken from the paper, shows the distribution of 9-factor (equity and currency exchange factors) alphas across the 1,649 fund-quarter observations during the sample period. Median quarterly alpha is -0.02%, and 50% of observations are positive. A majority of funds generate negative alpha for seven of 11 years (exceptions are 2002, 2008, 2011 and 2012). Average quarterly alpha is -0.06% (-0.40%) over 29 (15) quarters when the return for the MSCI ACWI is higher (lower) than the risk-free rate.

In summary, evidence indicates that global equity funds do not generate positive alpha after accounting for six equity factors and three currency exchange factors.

Cautions regarding findings include:

- The sample period is short in terms of variety of economic/market conditions.

- Realizing the statistical results outlined above reliably would require holding many global equity funds.