How should investors think about the interactions between working years (retirement account contributions) and retirement years (retirement account withdrawals)? In his June 2020 paper entitled “Retirement Planning: From Z to A”, Javier Estrada integrates working and retirement periods to estimate how much an individual should save and how they should invest to achieve a desired retirement income and ultimate bequest to heirs. He illustrates his analytical solution empirically for U.S. stocks and bonds, first using a base case plus sensitivity analysis and then using Monte Carlo simulations. His base case assumes:

- Work will last 40 years with a 60%/40% stocks/bonds retirement portfolio.

- Retirement will last 30 years with beginning-of-year real (inflation-adjusted) withdrawals of $60,000 from a 40%/60% stocks/bonds retirement portfolio and ultimate bequest $300,000.

Using annual data for U.S. stocks (the S&P 500 Index total return), bonds (10-year U.S. Treasury notes) and U.S. inflation during 1928 through 2019, he finds that:

- Over the test period, U.S. stocks and bonds deliver real annual total returns 6.5% and 1.9%, respectively, with volatilities 19.5% and 8.1% and annual return correlation 0.05.

- For the base case:

- With expected annual real return 4.2% during retirement, the required portfolio balance at retirement is $1,142,637.

- With expected annual real return 5.2% during working years, the annual real contribution required to achieve this balance at retirement is $9,079.

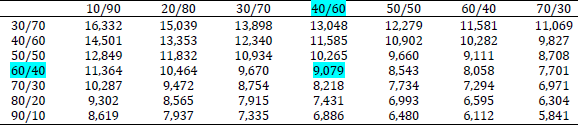

- Based on sensitivity analysis, all else equal, the less (more) the retirement portfolio tilts toward stocks during the contribution or withdrawal period, the more (less) the individual must contribute to the portfolio. (See the table below.)

- From 10,000 simulations based on statistical properties of the 60%/40% and 40%/60% during the full sample period, the probability that the retirement portfolio fails to achieve its goals is about 43%.

- Further simulations show that lowering the withdrawal rate by 10%, lowering the withdrawal rate from 5.3% to 4%, using 50%/50% allocations rather than 40%/60% during retirement, using 70%/30% allocations rather than 60%/40% while working, or increasing the annual contribution by 10% while working lowers portfolio failure rate to 26%-41%.

The following table, extracted from the paper, summarizes sensitivities of the required real annual retirement contribution according to the stocks/bonds allocations during: (1) working (contribution) years in the left column; and, (2) retirement (withdrawal) years in the top row. The highlighted 60/40 and 40/60 allocations are the base case above. Results indicate that higher allocations to stocks translate to lower required contributions.

Note that this analysis ignores effect of volatility (non-average path) on outcome.

In summary, simple modeling and simulations indicate that investors should plan for retirement early with aggressive saving and conservative spending plans to assure desired retirement income.

- The sample period (91 years) is very short compared to the investment lifecycle of 70 years.

- Analyses are in-sample, employing knowledge of returns on stocks and bonds for the full sample period.

- Historical returns are arguably not good predictors of future returns.