Is there a best way for investors to measure firm profitability for global stock selection? In their August 2018 paper entitled “Constructing a Powerful Profitability Factor: International Evidence”, Matthias Hanauer and Daniel Huber investigate which measure of firm profitability best predicts associated stock returns. They consider six measures: return on equity; gross profitability; operating profitability calculated in two ways; cash-based operating profitability (excluding accruals); and, cash-based gross profitability (also excluding accruals). They construct a long-short profitability factor for each measure and test its power to predict stock returns both standalone and in combination with other kinds of factors (market, size, book-to-market, momentum, investment and accruals) and the other profitability factors. Using monthly returns and annual accounting data for non-financial common stocks in 49 countries (excluding the U.S.) during July 1989 through June 2016, they find that:

- All profitability factors except return on equity reliably predict stock returns outside the U.S.

- The cash-based gross profitability factor generates the highest average monthly return and subsumes the other profitability factors based on multiple tests.

- All profitability factors have positive returns in each region (Europe, Japan, Asia Pacific excluding Japan and emerging markets). The cash-based gross-profitability factor is dominant in all regions except Europe, where cash-based operating profitability has slightly better performance.

- Profitability factors with stronger return predictive powers also better explain future firm earnings growth.

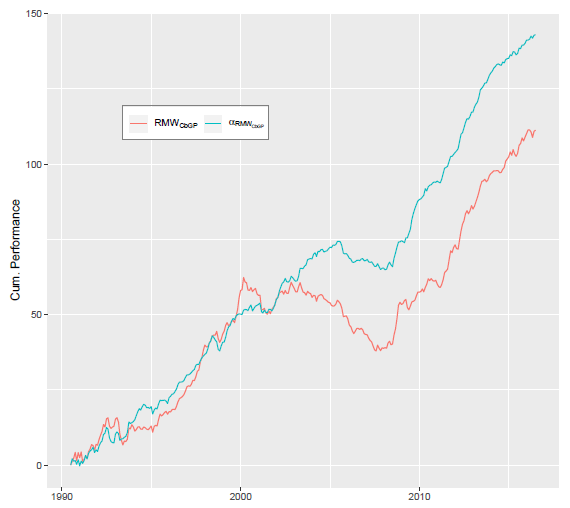

The following chart, taken from the paper, plots cumulative performances of the monthly cash-based gross profitability factor (RMWCbGP) and of the alpha of this factors after controlling for other kinds of equity factors. Performances are consistent during 1990 to 2000 and 2008 to 2016. Between 2000 and 2008, factor performance is flat to declining. After controlling for other factors, cumulative performance is stronger and steadier, with only a short flat to negative sequence between 2005 and 2008.

In summary, evidence indicates that a profitability factor based on cash-based gross profitability offers optimal return predictability among international stocks.

Cautions regarding findings include:

- Findings are gross, not net. Accounting for factor portfolio turnover frictions and shorting costs would reduce returns. Shorting as specified may be costly or infeasible for some stocks. Turnover may differ for alternative profitability factors, such that net relative performances may differ from gross relative performances.

- Testing multiple alternative profitability factors introduces data snooping bias, such that the best-performing factor overstates expectations.