Do alternative beta (factor-weighted) stock indexes present an exploitable advantage over traditional market capitalization weighting? In their February 2016 paper entitled “Alternative Beta Strategies”, Frank Benham, Roberto Obregon, Edmund Walsh and Timur Yontar analyze performance and practicality aspects of alternative beta stock indexes that target high value, high momentum, low volatility and high quality/profitability premiums. They also model multi-beta portfolios to assess the net benefits of beta diversification. Using monthly returns for market capitalization-weighted benchmark indexes and various alternative beta indexes as available through March 2015, they find that:

- Compared to the S&P 500 Index during April 1995 through March 2015, three value indexes:

- Produce higher gross average returns but also higher return standard deviations, and therefore comparable gross Sharpe ratios.

- Exhibit larger gross maximum drawdowns (during prolonged economic recessions).

- Have slightly positive exposure to the profitability factor and significantly negative exposure to the momentum factor.

- May have a basic trading friction advantage by offering liquidity.

- Compared to the S&P 500 Index during April 1995 through March 2015, two momentum indexes:

- Produce much higher gross average returns but also higher return standard deviations, with higher gross Sharpe ratios.

- Exhibit similar gross maximum drawdowns.

- Have significantly positive exposure to the volatility factor and (by design) negative exposure to the size factor.

- Exhibit high turnover and may have a basic trading friction disadvantage by taking liquidity.

- Compared to the S&P 500 Index during April 1995 through March 2015, two low-volatility indexes:

- Produce higher gross average returns and much lower volatilities, and therefore much higher gross Sharpe ratios.

- Exhibit substantially smaller maximum drawdowns.

- Have low exposure to the market factor compared to other alternative beta indexes (0.83 and 0.76) and positive exposure to the value factor.

- May have a basic trading friction advantage similar to that of value.

- Compared to the S&P 500 Index during October 2001 through March 2015, two quality/profitability indexes:

- Produce higher gross average returns and lower volatilities, and therefore much higher gross Sharpe ratios.

- Exhibit smaller maximum drawdowns.

- Have different factor exposures, indicating different construction methodologies.

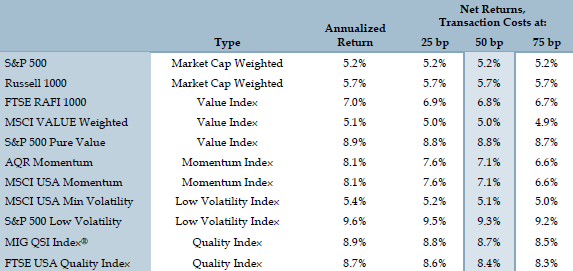

- For basic trading frictions (bid-ask spread) of 0.5%, momentum indexes bear the largest performance drag of 0.98% per year, compares to just 0.04% for market capitalization weighting. Drags for value, volatility and quality/profitability are closer to that of market capitalization weighting than momentum (see the table below).

- Due to liquidity and capacity constraints, alternative beta strategies have very limited availability in emerging markets.

- Pairwise return correlations among alternative beta indexes (ranging from 0.78 to 0.96) indicate some potential diversification benefits.

- Backtesting of portfolios that diversify across market and beta indexes, with estimated performance drags from index maintenance and beta rebalancing, indicates that:

- Net performance is better when the overall allocation to alternative betas is higher.

- More frequent rebalancing of alternative beta allocations (monthly rather than annually) enhances net performance.

- Diversification benefits come mostly from momentum and low-volatility betas.

The following table, taken from the paper, summarizes estimated impacts of three levels of basic trading frictions (bid-ask spread) on implementations of two market capitalization-weighted indexes and various alternative beta indexes. Results indicate that momentum strategies are much more costly to implement than other alternative betas.

In summary, evidence indicates that alternative beta allocations implemented with attention to costs are likely beneficial to overall equity portfolio performance.

Cautions regarding findings include:

- Sample periods are not long in terms of economic/market (and therefore perhaps factor) cycles.

- As demonstrated in the paper, alternative beta portfolios applied to equities alone offer, at best, only some relief from equity bear markets.

- Implementation cost estimates may not apply to small investors, who may pay material fees for access to alternative beta funds.