Are the least developed markets also the least efficient, and therefore the best places to look for alpha? Two recent papers address this question for large, sophisticated investors (institutional funds). In the October 2011 version of their paper entitled “Does Active Management Pay? New International Evidence”, Alexander Dyck, Karl Lins and Lukasz Pomorski examine the performance of the passive and active equity segments of large pension plans allocated to U.S., developed Europe, Australasia and Far East (EAFE) and emerging markets. In the November 2011 version of his paper entitled “Is There Any Alpha in Institutional Emerging Market Equity Funds?”, Wenling Lin examines the performance of institutional emerging market fund managers. Using data from the 1990s and 2000s, they find that:

From “Does Active Management Pay? New International Evidence”, based on a variety of tests on annual equity portfolio performance data for hundreds of U.S. and Canadian pension plans during 1993 through 2008, findings include:

- Over the sample period, average pension plan costs for passive (active) equity investing are 0.05% (0.40%) in the U.S. market, 0.10% (0.50%) in EAFE markets and 0.22% (0.79%) in emerging markets.

- On average, gross (net) annual returns for active equity strategies exceed those of passive equity strategies by about 1.5% (1.1%) in markets outside the U.S. Specifically, the average annual gap between active and passive net returns:

- Is about -0.3% in the U.S. market.

- Is around 0.5% in EAFE markets (not statistically significant in some tests).

- Exceeds 2.5% in emerging markets.

- Accordingly, the plans are least active in the U.S. market, more active in EAFE markets and most active in emerging markets, and the differences become more pronounced over the sample period.

From “Is There Any Alpha in Institutional Emerging Market Equity Funds?”, based on tests of quarterly returns including trading frictions but not management fees for a set of active institutional emerging market funds during January 1990 through June 2010, findings include:

- Over the sample period, emerging markets mature (see the chart below), and active emerging market fund managers give increasing attention to stock selection and quantitative technical/valuation strategies.

- Both growth and value funds tend to outperform those oriented to broad markets. Specifically, the average (median) annual alpha over the sample period is about:

- 0.70% (1.80%) for growth funds.

- 2.04% (2.81%) for value funds.

- 0.21% (0.93%) for active broad market-oriented funds.

- Results are substantially uncertain/risky. Diversification across strategies/styles would mitigate risk.

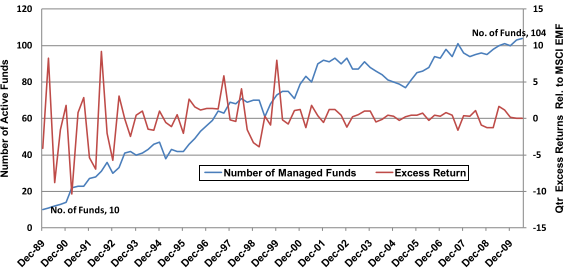

The following chart, taken from the paper, plots over the sample period: (1) the proliferation of active institutional emerging market funds; and, (2) average quarterly excess return of these funds relative to the MSCI Emerging Markets Free Index. Dampening of the variability in excess returns over time indicates a maturing category, with falling active risks and potentially declining aggregate alpha (perhaps due to growing fund manager emerging markets research capabilities).

In summary, evidence from institutional funds indicates that investors may be able to find more alpha in emerging equity markets than developed (especially U.S.) equity markets.

Cautions regarding findings include:

- Perhaps because data sources are indirect, the papers do not explicitly list the markets considered “emerging.” The list is probably similar to the components of the MSCI Emerging Markets Index (currently Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey) or the MSCI Emerging Markets Free Index cited above.

- As noted, findings from the second study exclude management fees.

- Sample periods, limited by data availability, are short for analysis of annual returns. Also, the number of funds is small in early subperiods.

- Individuals seeking access to the inefficiencies of emerging markets via retail mutual funds likely face management and administrative fees that materially offset available alpha. Similarly, small funds likely face higher frictions than the large funds sampled above.