Do equity option traders really bear the relatively large quoted bid-ask spreads as trading frictions? In their March 2015 paper entitled “Option Trading Costs Are Lower Than You Think”, Dmitriy Muravyev and Neil Pearson examine whether the predictability of changes in quoted option prices enables sophisticated investors to suppress option trading frictions. Instead of the bid-ask midpoint, they use a regression-based estimate of the “true value” of an option based on high-frequency publicly available information that reflects trade timing. Because trades tend to occur when true value estimates differ from respective bid-ask midpoints, their adjusted effective spreads (quoted versus true value) differ from the conventionally measured effective spreads. Using tick-level data for 37 individual U.S. stocks and two exchange-traded funds from both the equity and option markets during April 2003 through October 2006 (882 trading days, during which algorithmic trading grows to dominate option markets), they find that:

- Quoted option bid-ask spreads change little over the sample period, despite the more than doubling of option trading volume.

- Imminent changes in option price quotes are predictable using recent changes in underlying stock prices and other high-frequency public information.

- Most option trades are by proprietary traders and institutional investors who have access to option quote change prediction algorithms.

- Overall, 40% of option trades exploit predictability, buying (selling) just before option price quotes rise (fall).

- During the last month of the sample period, 54% of trades exploit predictability.

- On average, the adjusted effective spread is two thirds of the conventionally measured

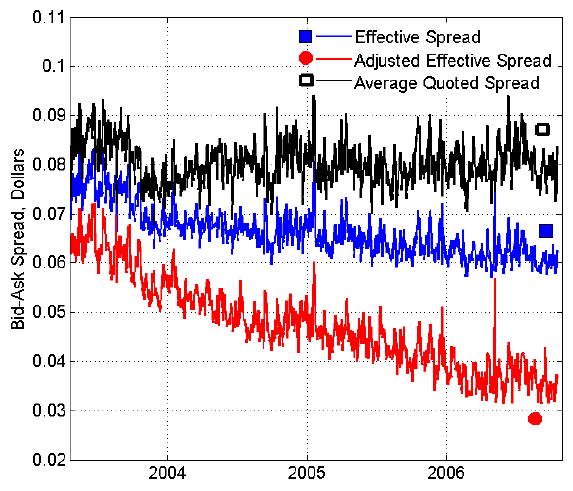

effective spread and only about half the quoted bid-ask spread. This new measure declines from 5.5 cents per unit to 3.5 cents per unit over the sample period, reflective of a doubling of the fraction of trades that exploits predictability of option quote changes (see the chart below). - For trades exploiting predictability of option quote changes, the average adjusted effective bid-ask spread is only 1.3 cents per unit, compared to 8.1 cents for the average bid-ask spread and 6.2 cents for the conventionally measured average effective spread. By the last month of the sample period, the effective adjusted spread for timed trades falls to 1.1 cents per unit.

- However, investors who are unable to time option trades bear on average the conventionally measured effective spreads.

- Market makers make spreads of in-the-money options relatively large because of their sensitivity to stock price movements and therefore susceptibility to prediction.

- Also, the conventionally measured effective spread overstates price impact of option trading by a factor of more than two.

The following chart, taken from the paper, shows the evolution of the average daily quoted (black), conventionally measured effective (blue) and adjusted effective (red) bid-ask spreads over the sample period. The quoted spread is an average of one-second snapshots over the entire day. The effective spread is twice the difference between trade price and the quote midpoint. The adjusted effective spread is twice the difference between trade price and the true value of the option.

Results show that true option trading frictions are on average smaller than, and declining relative to, conventionally estimated frictions. The reduced costs, however, concentrate among traders who are able to predict changes in quoted prices for options.

In summary, evidence indicates that sophisticated equity option traders increasingly exploit high-frequency price action of underlying assets to suppress option trading frictions by predicting changes in option quotes. Suppressed transaction costs likely expand the set of profitable trading strategies.

It seems reasonable to assume that the fraction of equity option trades that exploit predictability of changes in option price quotes has continued to grow since the end of the sample period.

Cautions regarding findings include:

- As noted in the paper, equity option trade timing based on expected change in option price quotes is likely beyond the reach of many individuals. Such individuals continue to bear relatively large trading frictions for options.

- Also as noted in the paper, option market makers may post relatively large bid-ask spreads to compensate for trade timing by counterparties. When they do, traders who do not time their option trades effectively subsidize those traders who do.