How well do equity index option strategies work during crises? In his October 2015 paper entitled “The Performance of Equity Index Option Strategy Returns during the Financial Crisis”, Dominik Schulte tests the profitability of long and short equity index option strategies during the financial crisis of 2008, including long (as defined) and short (opposite) versions of:

- Call: buy a call.

- Put: buy a put.

- Straddle: buy a call and sell a put with the same maturity and strike.

- Strangle: buy a call and a put with the same maturity, but with the call at a higher strike.

- Butterfly: buy in-the-money and out-of-the-money calls and sell two at-the-money calls, all with the same maturity.

- Put spread: sell an out-of-the-money put and buy an at-the-money put.

- Put-call spread: sell an out-of-the-money put and buy an at-the-money call.

He considers maturities of one to three months and moneyness from 90% to 110% as allowed. To assess the import of non-normal return distributions, he considers strategy return skewness, kurtosis and Omega ratio (which incorporates all moments). He estimates trading frictions from bid-ask spreads. Using end-of-month bids and asks for calls and puts on the S&P 500, the EuroStoxx 50 and the DAX indexes during January 2006 through September 2010, he finds that:

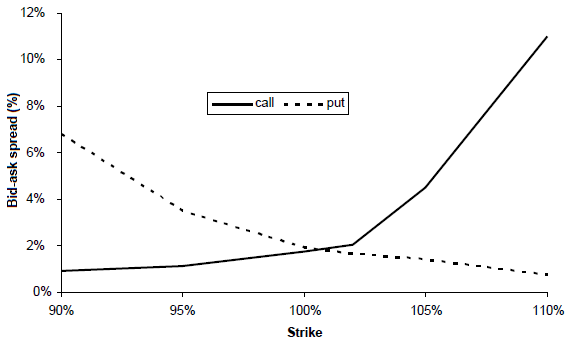

- The average equity index option bid-ask spread is 3.1%, generally increasing with moneyness (see the chart below). Spreads are slightly lower for S&P 500 Index options than for EuroStoxx50 and DAX options.

- Most of the strategies tested have materially non-normal return distributions.

- Most long strategies underperform the underlying index on a net basis over the sample period. However:

- Buying out-of-the-money puts on the S&P 500 Index has a higher net average return than the index.

- Buying put-call spreads on the DAX with maturities of two and three months has a higher net average return than the index.

- Most short option strategies outperform the underlying index on a net basis over the sample period.

- Near-the-money calls exhibit the highest frequency of profitability (74%).

- In general, return improvements relative to the underlying index from strategies that hold more than one option are modest due to bid-ask penalties. The butterfly strategy suffers especially due to multiple bid-ask spread penalties.

- Based on Omega ratios:

- For the S&P 500 and EuroStoxx 50 indexes, straddles with maturity two months and strikes 90% of the underlying are optimal.

- For the DAX, straddles with maturity two months and strikes 105% of the underlying are optimal. These DAX straddles have the highest average annual net return (21.6%) but also the highest standard deviation of monthly returns (7.7%).

- Shorting puts, strangles and straddles also generate Omega ratios higher than those of the underlying indexes.

The following chart, taken from the paper, shows the average bid-ask spreads of equity index (S&P 500 Index, EuroStoxx 50 and DAX) calls and puts as a percentage of bid price, depending on strike level relative to the underlying index (moneyness), during January 2006 through September 2010. The overall average bid-ask spread is 3.1%. Spreads for out-of-the-money options (calls with moneyness greater than 100% and puts with moneyness less than 100%) represent a substantial percentage of any trade.

Total trading frictions include broker fees and impact of trading due to insufficient market depth, in addition to bid-ask spread. Spreads may widen during crises, as market makers seek protection from illiquidity in hedge positions.

In summary, evidence indicates that selling straddles may be the best equity index option strategy during market crises.

Cautions regarding findings include:

- As noted in the paper, the financial crisis represents a rare environment that may not recur (and can dominate strategy performance when included in a sample).

- Trading frictions used to estimate net performance do not account for broker fees or impact of trading.

- Identification of optimal strategies/parameters involves snooping of many combinations, so optimal return statistics overstate expected performance.

- The paper does not consider crisis strategies beyond equity index options.

See also the live test of selling equity index put options during the financial crisis.