Do stock pricing factors predict option returns that are incremental to the factor premiums in underlying stock returns? In the December 2015 version of their paper entitled “Option Return Predictability”, Jie Cao, Bing Han, Qing Tong and Xintong Zhan examine whether 12 factors known to predict stock returns also predict delta-hedged (stock price-neutral) equity option returns. The 12 factors are: size, book-to-market, one-month reversal, momentum, accruals, asset growth, cash-to-assets, analyst earnings forecast dispersion, net stock issuance, idiosyncratic volatility, profitability and standardized unexpected earnings. For portfolio realism, they focus on monthly delta-neutral call writing. Specifically, for each factor each month, they:

- Rank stocks with dividend-unaffected options into tenths (deciles) based on the factor.

- Write an at-the-money call option with about 50 days to expiration and buy delta shares of each underlying stock (no daily hedge adjustments).

- Reform a portfolio that is long (short) the decile of delta-hedged written calls with the highest (lowest) expected factor returns.

They also look at a symmetric put strategy (buy a put and sell delta shares of the underlying stock). Using price/firm data for a broad (but groomed) sample of U.S. common stocks with options and daily closing bid and ask quotes for the specified options during January 1996 through December 2012 (a total of 5,179 underlying stocks), they find that:

- The average gross monthly return for holding delta-hedged call options (rehedged daily) is -1.03%.

- The average gross monthly return for delta-hedged call writing (not rehedged daily) is 3.67%.

- For the specified long-short delta-neutral call writing strategy, 8 of 12 stock pricing factor sorts are statistically and economically significant: size, one-month reversal, momentum, cash-to-assets, analyst earnings forecast dispersion, net stock issuance, idiosyncratic volatility and profitability. For these eight long-short decile portfolios:

- Gross equal-weighted average monthly returns (Sharpe ratios) based on executions at bid-ask midpoints range from 1.28% to 3.92% (0.63 to 2.00).

- Profitability is fairly stable over time and across different market conditions (even during the 2008-2009 financial crisis) and does not fade in recent years.

- Profitability holds for different weighting schemes.

- Each factor exhibits a somewhat independent ability to predict returns. Neither widely used risk factors nor market volatility explain profitability.

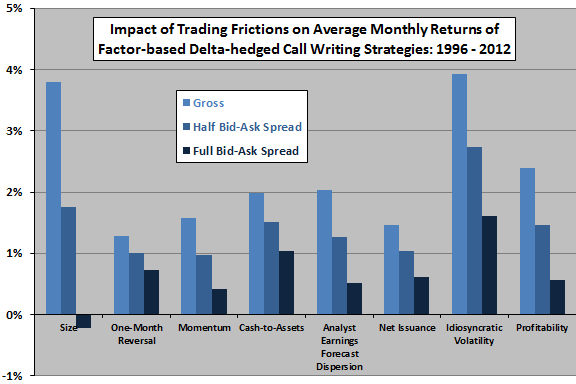

- Most strategies survive option trading frictions estimated as a fraction of bid-ask spread (see the chart below). However, profitability tends to decline with liquidity of underlying stocks.

- Similar results hold for a symmetric delta-neutral put strategy.

The following chart, constructed from data in the paper, summarizes impacts of option trading frictions scaled at half the option bid-ask spread and the full bid-ask spread on average monthly returns of the long-short delta-hedge call writing strategy applied to the eight equity factors exhibiting significant gross profitability. Results show that trading frictions materially reduce, but in most cases do not eliminate, profitability.

In summary, evidence indicates that common equity risk factors predict option returns above and beyond effects on underlying stock prices.

Results suggest that investors may be able to enhance covered call option writing via factor-based selection of stocks. However, the study does not separately evaluate the long and short sides of the delta-hedged call writing strategy.

Cautions regarding findings include:

- Estimated trading frictions do not explicitly account for broker fees and costs of establishing and liquidating delta-hedging stock positions.

- The market for options on individual stocks may not be deep enough to accommodate the specified strategy on a large scale.

- Testing many factors on the same data introduces snooping bias, such that the best-performing factor sort overstates expectations. Discarding “unsuccessful” factors from subsequent analyses obscures the overall level of snooping.

- Data collection/processing and reliable (many positions) execution of tested strategies are beyond the reach of many investors, who would bear fees for delegation to a fund manager.