Under what conditions should speculators buy protective equity options when they expect realized stock market volatility to increase? In their September 2018 paper entitled “Being Right is Not Enough: Buying Options to Bet on Higher Realized Volatility”, Roni Israelov and Harsha Tummala analyze the relationship between: (1) long volatility return (delta-hedged options) and same-interval changes in realized volatility; and, (2) the volatility risk premium (VRP, implied volatility minus realized volatility) and same-interval changes in realized volatility. They specify long volatility as a portfolio of cash-settled equity index options, reformed monthly, that:

- On each options expiration date, buys one-third of a -25 delta put option, one-third of a +25 delta call option and one-sixth each of at-the-money put and call options. All options initially have about a month to expiration.

- Each day until expiration, hedges option deltas via equity index futures.

- Holds the options to expiration.

They also examine sensitivity of outcome to different portfolio initiation and termination points relative to significant volatility increases. They focus on the S&P 500 Index, using VIX as implied volatility and hedging via S&P 500 Index futures, during January 1996 through December 2016. They also consider for robustness testing corresponding data for Eurostoxx 50, FTSE 100 and Nikkei 225. Using daily data as specified, they find that:

- Realized S&P 500 Index volatility increases over all 30-day periods 43% of the time during the sample period. Large drops in volatility tend to occur after large jumps, making bets on jumps risky.

- Average gross annualized return and gross annualized Sharpe ratio are:

- -1.7% and -1.1, respectively, for all months.

- 1.1% and 0.6, respectively, for months when realized volatility increases. Positions are profitable for about half of months.

- -3.9% and -3.9, respectively, for months when realized volatility decreases.

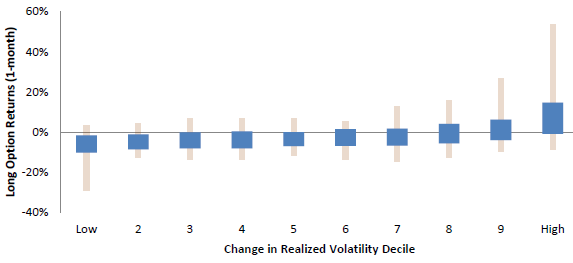

- Ranking monthly realized volatilities more precisely into tenths, or deciles, shows that (see the chart below):

- The long volatility portfolio is profitable only for the two deciles with the largest realized volatility increases (9 and 10). Returns are positive slightly more than half the time (85% of the time) for decile 9 (10). Average gross annualized return for decile 10 is 6.6%, compared to -2.7% across the other nine deciles.

- VRP is positive more than 90% of the time in deciles 1-7, and positive more than 65% of the time in deciles 8 and 9. VRP is consistently negative (such that the long options portfolio is attractive) only for decile 10.

- The long volatility portfolio bleeds capital while waiting for a volatility spike, and loses money if the wait is longer than four months. In other words, a long volatility speculator must achieve good timing in predicting volatility spikes.

- Results are similar for the non-U.S. equity markets.

The following chart, taken from the paper, summarizes average annualized gross monthly return distributions for the long option portfolio as specified above by decile of same-month realized volatilities. Boxes depict 80% confidence intervals, and whiskers show minimum and maximum values. Results show that long option portfolio returns are consistently negative in most deciles, positive slightly more than half the time in decile 9, and consistently positive (85% of the time) in decile 10.

In summary, evidence indicates that successfully using a long equity index option portfolio to exploit stock market volatility spikes requires precise forecasting of the magnitude and timing of such spikes.

Cautions regarding findings include:

- As described in the paper, many of the tests used assume perfect foresight of future realized volatility. Speculators would be less accurate than the tests.

- Analyses are gross, not net. Accounting for costs of monthly option buys and daily delta hedging actions would lower returns and make the proposition of timing equity index volatility spikes even less attractive.

For recent relevant research, see:

- “Are Equity Put-Write ETFs Working?” (for the tailwind side of the above headwind)

- “Best Index Options to Sell?” (for the tailwind side again)

- “Do Protective Equity Index Puts Work Well?” (for the headwind side, as above)

- “Profitability of Systematically Selling Equity Index Put and Call Options” (for the tailwind side again)