Risk parity asset strategies generally make large allocations to low-volatility assets such as bonds, which tend to fall in value when interest rates rise. Is risk parity a safe strategy when rates rise? In their June 2014 research note entitled “Risk-Parity Strategies at a Crossroads, or, Who’s Afraid of Rising Yields?”, Fabian Dori, Manuel Krieger, Urs Schubiger and Daniel Torgler examine how the rising interest rate environment of the U.S. in the 1970s affects risk parity performance. They also examine how inflation and economic growth affect risk parity performance. They use the yield on the 10-year U.S. Treasury note (T-note) as a proxy for the interest rate. Their risk parity model uses 40-day past volatility for risk weighting and allows leverage to target an annualized portfolio volatility (7.5%, per Fabian Dori). They consider two benchmark portfolios: conservative, allocating 60% to bonds, 30% to stocks and 10% to commodities; and, aggressive, allocating 40% to bonds, 40% to stocks and 20% to commodities. They rebalance all portfolios daily, including estimated transaction costs. They compare six-month returns of risk parity and benchmark portfolios across ranked fifths (quintiles) of contemporaneous six-month changes in interest rates, inflation and Gross Domestic Product (GDP) growth rate. Using daily levels of a generic 10-year T-note, the S&P 500 Index and the Goldman Sachs Commodity Index during January 1970 through June 1996 and actual daily futures prices for 2-year, 5-year and 10-year T-notes, the S&P 500 Index, the NASDAQ 100 Index and the DJ UBS Commodity Index during July 1996 through April 2014, along with contemporaneous interest rate, inflation and GDP data, they find that:

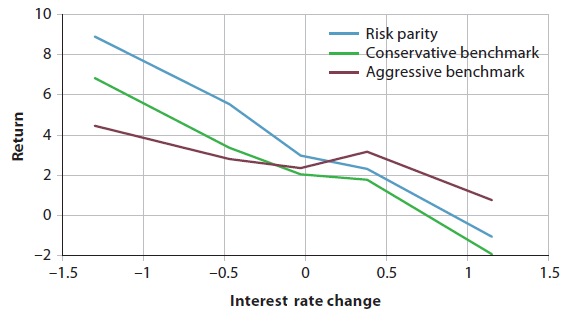

- Over the entire sample period across the full range of interest rate changes (see the chart below):

- Risk parity consistently outperforms the conservative benchmark, but generates negative returns for extreme jumps in interest rates.

- Risk parity substantially outperforms (modestly underperforms) the aggressive benchmark when the interest rate is falling (rising). However, the aggressive benchmark suffers a maximum drawdown of -30%, compared to -21% for risk parity and -25% for the conservative benchmark.

- Risk parity performs best versus the benchmarks when the interest rate, inflation and economic growth all rise gradually.

- In other words, risk parity combines strong performance when the interest rate falls with good crash protection.

- Risk parity’s attractiveness derives primarily from the fact that stock and especially commodity gains offset bond losses when the interest rate rises.

- Risk parity consistently generates positive returns and outperforms the benchmarks for both rising and falling inflation, with commodity gains offsetting stock losses when inflation spikes.

- Risk parity consistently generates positive returns and almost always outperforms the benchmarks during both economic expansions and economic contractions.

- It appears that some reallocation rule other than risk-balancing is necessary to mitigate the effects of shocks that elevate correlations between asset classes and thereby reduce diversification benefits.

The following chart, taken from the paper, summarizes the performance of risk parity and benchmark portfolios across ranges of interest rate changes since 1970. Risk parity consistently outperforms the conservative benchmark (high allocation to bonds) but outperforms the aggressive benchmark (moderate allocation to bonds) only when the interest rate falls. However, risk parity suffers a smaller maximum drawdown than the aggressive benchmark.

In summary, evidence indicates that risk parity is relatively effective at harvesting diversification benefits while bearing relatively low downside risk across wdie ranges of changes in interest rates, inflation and GDP growth.

Cautions regarding findings include:

- Analyses are contemporaneous rather than predictive, such that exploitation of specific findings requires materially accurate forecasts of the independent variables (interest rate, inflation and GDP growth).

- Even the “aggressive” benchmark allocation does not tilt toward stocks.

- Some investors may not be able to achieve the trading friction assumed in daily rebalancing of portfolios (0.02% per trade, per Fabian Dori). Frequent, low-cost rebalancing may be essential to the relatively attractive performance of risk parity.

- For more than half the sample period, the study employs indexes as asset class proxies. Indexes do not include costs of maintaining liquid trading vehicles. Moreover, market behaviors may be different when liquid assets are and are not available.

- There may be snooping bias in the selection of the volatility measurement interval and target risk level.