The Federal Reserve states that open market operations regulate “the aggregate level of balances available in the banking system,” thereby keeping the effective Federal Funds Rate close to a target level. The operations are predominantly repurchases, whereby the Federal Reserve provides liquidity. Do Permanent Open Market Operations (POMO) systematically affect the nominal or real yields on 10-year Treasury notes (T-notes)? Using monthly amounts of Treasuries repurchases via POMO during August 2005 through May 2013 (94 months) and contemporaneous monthly T-note yields and 12-month trailing inflation rates, we find that:

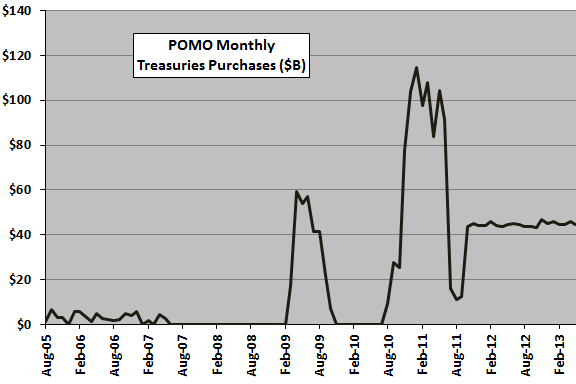

The following chart summarizes POMO activity in billions of dollars aggregated by calendar month over the sample period. Large POMO interventions commence in March 2009 and comprise three phases.

Do POMO interventions since the beginning of March 2009 affect the T-note yield?

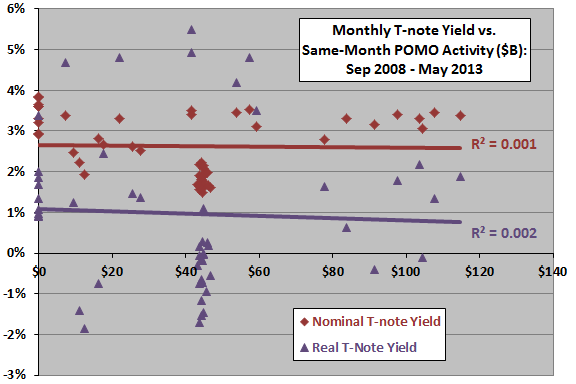

The following scatter plot relates the month-end nominal and real T-note yields to the same-month volume of POMO purchases of Treasuries (in billions of dollars) during March 2009 through May 2013 (51 months). The real T-note yield is the difference between the end-of-month nominal T-note yield and the lagged 12-month consumer price inflation rate for the prior month (to ensure it would be known by the end of the month).

For the relationship between nominal T-note yield and monthly POMO activity, the Pearson correlation is -0.03 and the R-squared statistic is 0.001, indicating that nominal T-note yield is practically insensitive to level of POMO purchasing at a monthly horizon.

For the relationship between real T-note yield and monthly POMO activity, the Pearson correlation is -0.05 and the R-squared statistic is 0.002, indicating that real T-note yield is also practically insensitive to level of POMO purchasing at a monthly horizon.

In summary, evidence from a simple test on a small sample does not support a belief that POMO repurchase activity affects nominal and real T-note yields on a monthly basis.

Cautions regarding findings include:

- The analyzed subsample is small, especially for the highly dispersed real yield.

- While monthly variation in POMO activity may not affect T-note yields, the aggregate effect of the stated Federal Reserve intention to repurchase large amounts of Treasuries over an extended period may depress the yields.

- The Federal Reserve may target different maturities of Treasury instruments in different POMO phases.

- Using an expected inflation rate to estimate the real T-note yield may change results.