Is gold a consistent hedge against inflation? In their October 2015 preliminary paper entitled “Is Gold a Hedge Against Inflation? A Wavelet Time-Frequency Perspective”, Thomas Conlon, Brian Lucey and Gazi Salah Uddin examine the inflation-hedging properties of gold over an extended period at different measurement frequencies (investment horizons) in four economies (U.S., UK, Switzerland and Japan). They consider both realized and unexpected inflation. They also test the inflation-hedging ability of gold futures and gold stocks. Using monthly consumer price indexes (not seasonally adjusted) for the four countries and monthly returns for spot gold (bullion) in the four associated currencies since January 1968, monthly survey-based U.S. inflation expectations since January 1978, and monthly returns on the Philadelphia Gold and Silver Index (XAU) as a proxy for gold stocks since January 1984, all through December 2014, they find that:

- During 1968-2014, average monthly inflation rates for the U.S., UK, Switzerland and Japan are 0.3%, 0.5%, 0.2% and 0.2%, respectively. Over the same period:

- Average monthly returns for spot gold in local currencies are 0.6%, 0.7%, 0.4% and 0.4%, respectively.

- The maximum monthly return for spot gold in all four countries occurs in January 1980 (+40.8% in U.S. dollars). This observation can dominate hedging analyses.

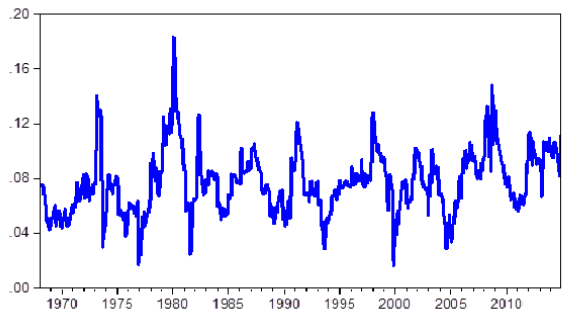

- A dynamic (GARCH ) correlation based on monthly data indicates that spot gold is a weak and somewhat inconsistent inflation hedge (see the chart below).

- A wavelet approach indicates that spot gold acts as a short-term and long-run inflation hedge at many times in all four countries, strongly so up to the mid-1980s.

- Based on U.S. survey-based expectations:

- Spot gold acts as a short-term and long-term hedge against unexpected U.S. inflation.

- There are episodes of negative co-movement between spot gold and unexpected inflation in other countries (when inflation unexpectedly drops).

- Gold futures act like spot gold in hedging inflation. Gold stocks frequently act as an inflation hedge.

- Findings are similar for producer price inflation.

The following chart, taken from the paper, shows a rolling correlation between monthly U.S. inflation (not seasonally adjusted) and monthly spot gold return during 1968 through 2014. The correlation is always positive but fairly low (less than 0.19). The most prominent feature is a spike in 1980, during a period of high inflation. Unlike wavelet analysis, this dynamic correlation approach does not support examination of gold-inflation relationships at different measurement frequencies.

In summary, evidence indicates that spot gold and gold futures work as actual inflation hedges at both long and short horizons across developed markets, and as an unexpected inflation hedge in the U.S.

Cautions regarding findings include:

- Analyses are more theoretical than practical. Translation of wavelet power diagrams into investment stances is not obvious.

- There are no explorations of how to incorporate gold into an investment portfolio.