Does anticipation of Federal Open Market Committee (FOMC) monetary policy announcements move the market? Is any such anticipation permanent? In the June 2012 revision of their paper entitled “The Pre-FOMC Announcement Drift”, David Lucca and Emanuel Moench investigate the effects of FOMC announcements on global equity markets. They focus on the U.S. stock market during the 24-hour interval from 2 PM on the day before to 2 PM on the day of scheduled FOMC announcements. Using FOMC announcement dates and intraday returns for the S&P 500 Index, other major stock market indexes and other asset classes, and daily returns for individual U.S. stocks and 49 industries, during February 1994 through March 2011 (131 scheduled FOMC meetings), they find that:

- Over the sample period, S&P 500 Index returns during the 24 hours prior to scheduled FOMC announcements account for over 80% of the gross equity premium. More specifically:

- During 2PM one day to 2PM the next day, U.S. stock market average gross return is 0.49% (0.004%) just before FOMC announcements (all other days). 98 (33) of pre-announcement returns are positive (negative).

- An investor holding the S&P 500 Index only during the 24 hours preceding FOMC announcements earns an average annual gross return above the risk-free rate of 3.89%, compared to 0.89% for holding the index the rest of the time, translating to an annualized gross Sharpe ratio of 1.14.

- On a close-to-close basis, an investor holding the S&P 500 Index only on FOMC announcement days earns an average annual gross return above the risk-free rate of 2.70%, compared to 2.03% for holding the index all other days, translating to an annualized gross Sharpe ratio of 0.84.

- In contrast, the average gross excess return between 2PM and the close on FOMC announcement days is zero. In other words, the FOMC on average does not surprise investors.

- This FOMC pre-announcement effect is:

- Persistent through subsequent trading days (does not reverse).

- Generally persistent over the sample period.

- Not driven by outliers.

- Not related to the actual policy action (loosening or tightening).

- Present but somewhat lower for small firms.

- Significant for 36 out of 49 industry portfolios.

- Short-term realized volatility and trading volume tend to be somewhat lower just before FOMC announcements than on other days, but jump substantially at the announcement.

- Other major country stock indexes (excluding Japan) exhibit similar behavior around FOMC announcements (but not around monetary policy announcement days of their own central banks).

- No FOMC pre-announcement effect is evident in fixed income and foreign exchange markets.

- No pre-announcement effect is evident for other major macroeconomic data releases.

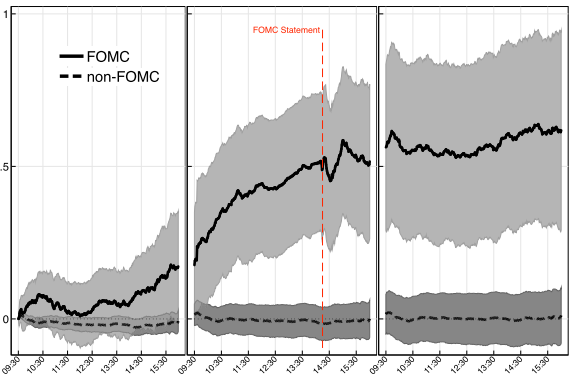

The following chart, taken from the paper, plots average gross cumulative intraday (one-minute) S&P 500 Index returns in percentage points over three-trading day windows during the sample period for:

- Windows centered on the 138 FOMC announcement days (solid black line, with the dashed vertical red line marking the 2:15 PM announcement time).

- Windows excluding the three trading days bracketing FOMC announcements (dashed black line).

The solid line shows that the index tends to rise during the afternoon of the day before schedule FOMC announcements and continue to rise during announcement day morning for a total gain of about 0.5%. Immediately after announcement, the index tends to fall for about fifteen minutes but then reverse to about the 2 PM level. The market tends to be flat the day after FOMC announcements.

The dashed line shows that the index tends to be flat over three-day windows that exclude the days around FOMC announcements.

In summary, evidence indicates that investors may be able to exploit a tendency for most major stock market indexes to rise during the 24 hours before scheduled FOMC monetary policy announcements.

Cautions regarding findings include:

- Return calculations are gross, not net. A trading strategy designed to exploit findings would incur trading frictions material in size compared to excess returns.

- Statistical significance tests assume tame return distributions. To the extent actual return distributions are wild, these tests lose validity.