Has easy access to commodity allocations via exchange-traded instruments (financialization) changed the way commodity prices interact with the economy? In his February 2014 paper entitled “Macroeconomic Determinants of Commodity Returns in Financialized Markets”, Adam Zaremba investigates relationships between commodity returns and economic conditions in pre-financialization (before 2004) and post-financialization (2004 and after) environments. He defines an increase (decrease) in the nominal U.S. Industrial Production Index as economic growth (contraction). He employs the U.S. Consumer Price Index (CPI) to measure inflation. Using monthly levels of various global and sector commodity indexes in U.S. dollars as available, the nominal U.S. Industrial Production Index and CPI during December 1970 through November 2013, he finds that:

- Post-financialization commodity returns link much more tightly with economic activity than pre-financialization returns. Based on quarterly (annual) measurements, the contemporaneous correlation between S&P-GSCI total returns and changes in U.S. industrial production rises from a pre-financialization 0.21 (0.12) to a post-financialization 0.41 (0.70).

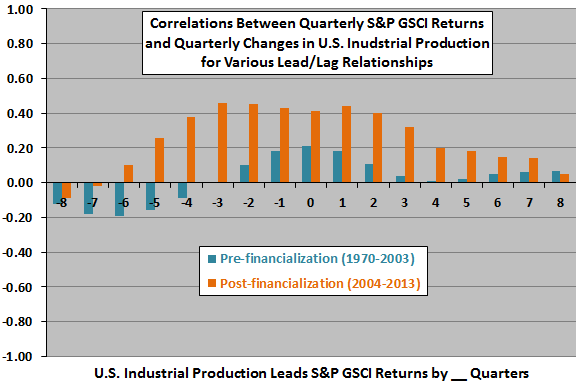

- The relationship between commodity returns and the business cycle is more equity-like post-financialization than pre-financialization, with commodity prices now mirroring or somewhat leading industrial production (see the chart below). In other words, the effectiveness of commodities for diversifying stock portfolios declines.

- The link between commodity returns and CPI changes strengthens in recent years. It still makes sense to hold commodities as an inflation hedge. Based on quarterly (annual) measurements:

- The contemporaneous correlation between realized inflation and S&P-GSCI total returns increases from a pre-financialization 0.16 (0.32) to a post-financialization 0.71 (0.73).

- The contemporaneous correlation between unexpected inflation (unpredicted by the risk-free rate or surveys) and S&P-GSCI total returns increases from a pre-financialization 0.19 (0.48) to a post-financialization 0.60 (0.81).

The following chart, constructed from data in the paper, compares correlations between quarterly S&P GSCI total returns and quarterly changes in U.S. industrial production for lead-lag relationships ranging from commodity prices lead production by eight quarters (-8) to production leads commodity prices by eight quarters (8), both before (Pre-) and after (Post-) financialization of commodity markets. Results suggest that financialization of commodities:

- Strengthens the link between industrial production and commodity prices considerably.

- Makes commodity prices anticipate industrial demand.

In summary, evidence suggests that financialization of commodities over the last decade makes their performance more equity-like than before.

Cautions regarding findings include:

- Use of commodity indexes rather than tradable assets does not take into account the costs of maintaining liquid instruments for trading, including management fees. Since such costs may change over time, accounting for them may affect findings.

- Subsamples (especially for post-financialization) are very small for annual measurement intervals and extremely small in terms of number of business cycles.