What is “under the hood” at quantitative investment firms? In their December 2016 book-length paper entitled “Factor Investing and Asset Allocation: A Business Cycle Perspective”, Vasant Naik, Mukundan Devarajan, Andrew Nowobilski, Sebastien Page and Niels Pedersen examine the process of translating macroeconomic forecasts into alpha-generating portfolios via mean-variance optimization. They address how to: (1) specify the risk factors driving returns in global financial markets; (2) estimate factor returns and volatilities; and, (3) construct an optimal portfolio of factors. They emphasize the primacy of the business cycle in estimating future returns and volatilities of risk factors across multiple asset classes. They also emphasize the importance of market valuations (to identify when price fluctuations create tactical opportunities) in investment decision making. Based on the body of financial markets research over the last 50 years and their own experiences with the investment process, they conclude that:

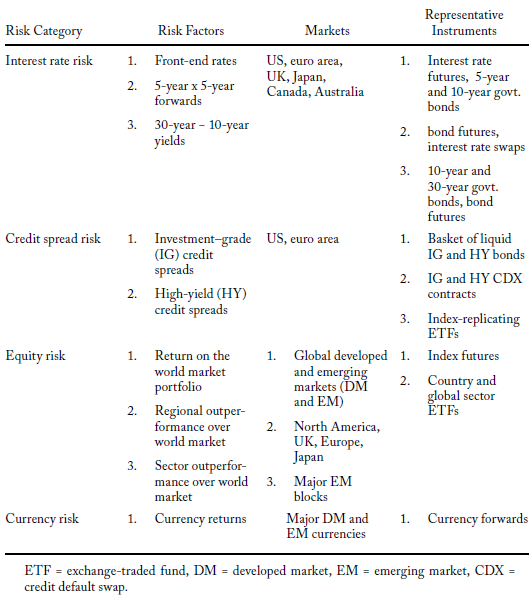

- A reasonably sparse set of risk factors (see the table below) is adequate to estimate allocations for global equities, bonds and currencies.

- Investors should include in the asset allocation process models (based on robust historical samples) describing how risk factor volatilities and correlations depend on both economic conditions (cyclicality/counter-cyclicality, inflation and credit risk) and technical indications (short-term reversion and medium-term persistence).

- The optimal portfolio should balance genuine systematic risk factors and avoid transitory effect and artifacts of data snooping.

- The investment process should overweight (underweight) assets that are cheap (expensive) based on measures of cash flows. Empirical experiments suggest using a “portfolio of signals” for valuation rather than a single metric. Value-driven strategies can, however, underperform over extended periods because mean reversion is slow. Investors can mitigate this weakness by employing complementary momentum signals that capture higher-frequency information.

- The main criticisms of the mean-variance optimization process are: (1) it requires many estimates of asset returns, volatilities and correlations (all subject to errors); and, (2) it can generate very leveraged long-short positions in highly correlated risk factors. Investors should judiciously apply simplifications, position constraints and tail effect protections in risk-return trade-offs.

- Alternative asset classes have significant exposures to the same risk factors that drive volatility in stocks and bonds. Investors should require a compensating higher return from such (illiquid) assets.

The following table summarizes risk factors for global stocks-bonds-currencies for use in portfolio construction.

In summary, a prudent investment process balances multiple sources of risk primarily across equities, bonds and currencies, with valuation (and perhaps complementary momentum) tilts.

Cautions regarding conclusions include:

- The process outlined is beyond the reach of many investors, who bear fees for accessing it via funds.

- The paper does not emphasize what level of performance or outperformance investors should expect from the process.