Are there economic and financial variables that meaningfully predict return volatilities of financial markets? In their March 2012 paper entitled “A Comprehensive Look at Financial Volatility Prediction by Economic Variables”, Charlotte Christiansen, Maik Schmeling and Andreas Schrimpf investigate the ability of 38 economic and financial variables to predict return volatilities of four asset classes (stocks, foreign exchange, bonds and commodities). Asset class proxies are: (1) the S&P 500 Index; (2) spot levels for a basket of currencies versus the U.S. dollar; (3) 10-year Treasury note futures contract prices; and, (4) the S&P GSCI. They calculate actual (realized) monthly asset class volatilities from daily returns. They construct out-of-sample volatility forecasts based on iterative inception-to-date regressions of volatilities versus predictive variables. They use an autoregressive model (simple realized volatility persistence) as a benchmark. Using monthly data for 13 economic/financial variables and the S&P 500 Index realized volatility over the long period December 1926 through December 2010 (1,009 months) and monthly data for 38 variables and all four asset class volatilities during 1983 through 2010 (366 months), they find that:

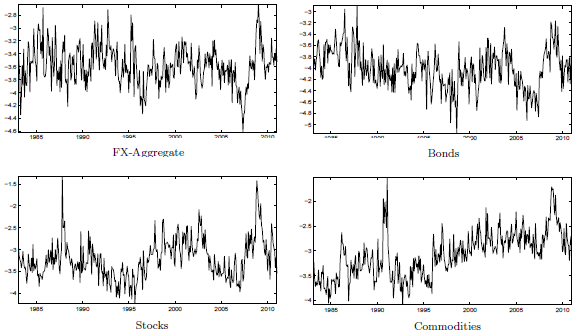

- Pairwise correlations of asset class volatilities are small to modest during 1983-2010, with that between stocks and commodities the highest at 0.48, suggesting that different variables drive volatilities of different asset classes (see the charts below).

- Realized volatility is persistent for all four asset classes, such that the simple autoregressive benchmark (lagged volatility) is consistently one of the best individual predictors of future volatility.

- In-sample tests suggest that variables related to credit risk (positive relationship) and liquidity (negative relationship) predict return volatility across asset classes. Valuation ratios by asset class, such as earnings-price ratio for stocks and interest rate differential for foreign exchange (negative relationships) also perform well as return volatility predictors. In contrast, variables related to general economic conditions are much less informative.

- Out-of-sample tests based on somewhat complex models suggest that adding financial variables to simple volatility persistence can improve prediction. However, improvements do not hold for all asset classes and vary substantially over time.

The following charts, taken from the paper, track the logarithm of realized volatilities for foreign exchange (FX-Aggregate), bonds, stocks and commodities during 1983 through 2010. The series are highly variable but not highly correlated, suggesting different volatility drivers for different asset classes.

In summary, evidence suggests relationships between financial (but not economic) variables and future volatility of different asset classes, but useful out-of-sample predictive power is elusive.

Cautions regarding findings include:

- Prediction models entail considerable data collection and complexity.

- The study makes no effort to exploit findings via investing/trading strategies.

A harried investor/trader might review findings and decide that the consistent positive relationship between lagged volatility and future volatility across asset classes (implying mean reversion) is good enough for strategic allocation and tactical trading.