Does the stock market perform poorly in a deflationary environment? In the September 2016 version of his paper entitled “Deflation and Stock Prices”, Michael Clemens explores relationships between change in the Consumer Price Index (CPI) and each of stock market return and stock market valuation. He defines four deflation/inflation regimes based on ranges of annualized average monthly change in CPI over the previous 12 months. He considers both contemporaneous (last 12 months) and future (next 12 months) stock market returns. He measures stock market price-earnings ratio (P/E) as the average of Robert Shiller’s Cyclically Adjusted Price-Earnings Ratio (CAPE or P/E10), 12-month historical P/E and 12-month future P/E known with perfect foresight. Using Shiller’s U.S. monthly data spanning January 1871 through February 2016 and shorter, recent samples for Japan (January 2001 through February 2016) and Switzerland (January 2005 through February 2016), he finds that:

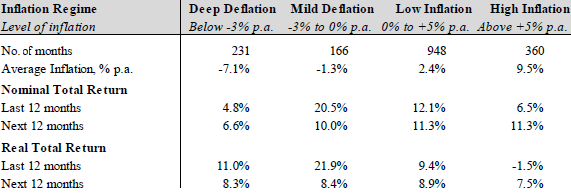

- For the long U.S. sample (see the table below):

- Periods immediately preceding mild deflation have the highest average nominal and real stock market returns.

- Average nominal next-year returns are lowest during months of deep deflation (< -3% per year) and highest during inflationary months (> 0% per year).

- Average real next-year stock market returns are lowest for severe inflation (> 5% per year) and about average for mild and deep deflation (< 0% per year).

- Average P/E is highest when inflation is low (16.9) and declines much more during high inflation (10.4) than during mild deflation (15.5) or deep deflation (14.5). These findings hold for 1872-1951 and 1952-2016 subsamples (except there are no observations of deep deflation in the latter).

- Recessions appear to cause deflation rather than vice versa (suggesting that collapses in demand cause deflation).

- The 1930s appear not to be representative of the relationship between deflation and stock market behavior.

- For Switzerland, stock market P/E is higher during recent mild deflation than during inflation. For Japan during 2010-2016, the opposite holds.

The following table, extracted from the paper, summarizes average 12-month past and 12-month future nominal and real S&P Composite Index total returns for four annualized deflation/inflation regimes as specified above over the entire sample period. Results are robust to +/- 1% shifts in regime boundaries and to use of 6-month rather than 12-month stock market returns. Results indicate that the best environment for the stock market is low inflation, but deflationary environments are not unattractive.

In summary, some evidence suggests that equity investors need not fear deflation per se.

Cautions regarding findings include:

- Emphasis in the paper on the relationship between inflation and P/E obscures any usefulness of findings for timing the stock market. The paper does not tackle use of P/E for market timing (see “Usefulness of P/E10 as Stock Market Return Predictor”).

- Calculations do not account for lags in availability of CPI data (about half a month) and earnings data (as much as a few months) relative to stock market returns. Inserting these lags may have some affect on findings.

- As noted in the paper, the specified P/E has look-ahead bias.

- Current markets may exhibit behaviors different from those of over a century ago.

- Shiller return and P/E calculations are somewhat “blurry” since monthly index levels are the average of daily levels during the month.

- Monthly calculations of 12-month average monthly change in CPI and 12-month returns (and especially 120-month average earnings for P/E10) overlap, confounding independence of observations. This approach may materially distort/overstate findings based on averages. This issue is of particular concern for the short Japanese and Swiss market samples/subsamples.

- The paper does not explain why the 1930s appear to be unrepresentative of deflationary environments.

See also “CPI and Stocks Over the Short and Intermediate Terms”.