Do changes in the dollar-euro exchange rate reliably interact with the U.S. stock market and gold? For example, do declines in the dollar relative to the euro indicate increases in the dollar value of hard assets? Are the interactions coincident or exploitably predictive? To investigate, we relate changes in the dollar-euro exchange rate to returns for U.S. stock indexes and spot gold. Using end-of-month and end-of-week values of the dollar-euro exchange rate, levels of the S&P 500 Index and Russell 2000 Index and spot prices for gold during January 1999 (limited by the exchange rate series) through October 2016, we find that:

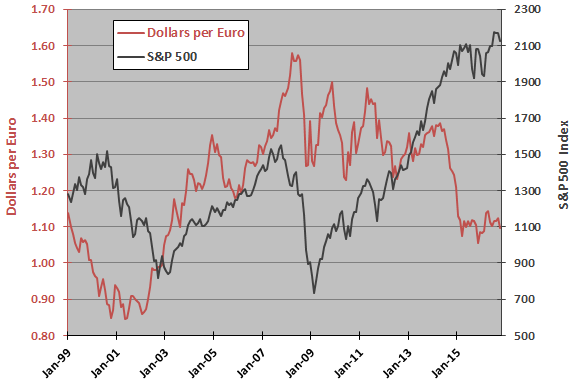

The following chart compares the monthly values of the dollar-euro exchange rate and monthly levels of the S&P 500 Index over the available sample period. Visual inspection suggests no clear relationship between the two series.

For greater precision, we relate monthly changes in the series.

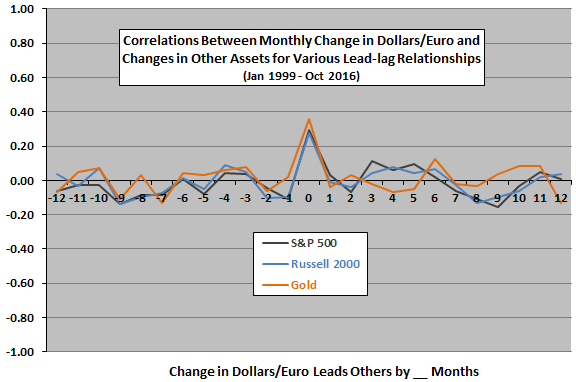

The next chart summarizes Pearson correlations between monthly changes in the dollar-euro exchange rate and monthly changes in each of the S&P 500 Index, the Russell 2000 Index and spot gold price for lead-lag relationships ranging from the other series lead changes in the exchange rate by 12 months (-12) to changes in the exchange rate lead the other series by 12 months (12).

Coincident correlations (lag 0) are uniformly positive. An increase (decrease) in the value of the dollar against the euro indicates a tendency for the U.S. stock market and gold price to decline (advance). However, non-coincidental correlations appear to be noise, such that there are no useful predictive relationships in either direction.

There appear to be no significant differences between exchange rate interactions for large stocks (S&P 500 Index) and small stocks (Russell 2000 Index).

Might leading or lagging relationships show up with finer, weekly data?

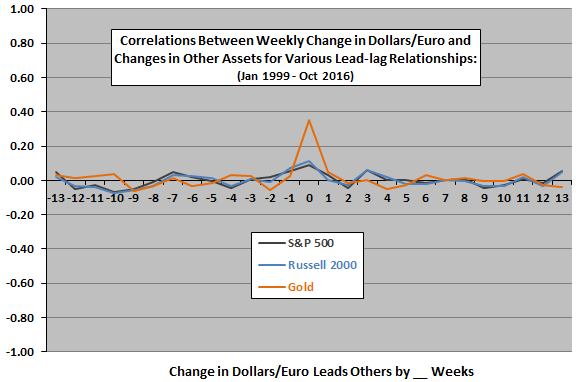

The next chart summarizes Pearson correlations between weekly changes in the dollar-euro exchange rate and weekly changes in each of the S&P 500 Index, the Russell 2000 Index and spot gold price for lead-lag relationships ranging from the other series lead changes in the exchange rate by 13 weeks (-13) to changes in the exchange rate lead the other series by 13 weeks (13).

Coincident correlations (lag 0) are again uniformly positive, notably stronger for gold than stocks. Again, an increase (decrease) in the value of the dollar against the euro indicates a tendency for the U.S. stock market and especially gold price to decline (advance). However, again, non-coincidental correlations appear to be noise, such that there are no useful predictive relationships in either direction.

Correlation analysis assumes linear relationships between series. Could there be exploitable non-linearities?

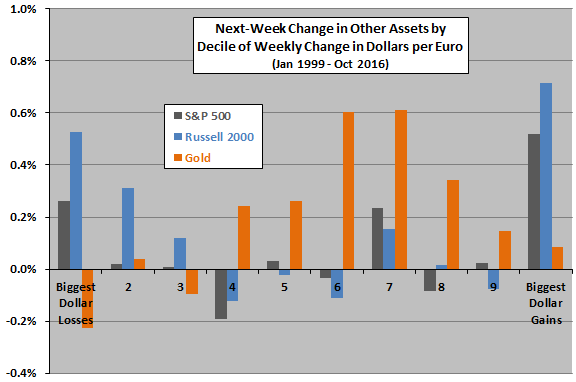

The final chart summarizes average next-week returns for the S&P 500 Index, the Russell 2000 Index and spot gold by ranked tenth (decile) of weekly change in the dollar-euro exchange rate. There are 93 observations per decile. The biggest dollar losses (gains) correspond to the largest increases (decreases) in the dollar-euro exchange rate.

Both extreme losses and extreme gains for the dollar indicate positive U.S. stock market returns the next week, with the effect stronger for small stocks than large stocks. For deciles 2 through 9, there are no interesting interactions.

A stable exchange rate apparently augurs best for next-week spot gold appreciation. For extreme fluctuations, interactions are not very interesting.

In summary, evidence from simple tests on available data indicates largely unexploitable coincident relationships between the dollar-euro exchange rate and U.S. stocks/gold, with U.S. stocks tending to be strong in the short term when the rate moves dramatically.

Cautions regarding findings include:

- The sample is short in terms of number of economic cycles.

- All series are indexes rather than tradable assets. Incorporating costs of creating and maintaining funds as proxies for these indexes would lower returns.

- Analyses are in-sample, such that (for example) the decile breakpoints in the last chart may shift over time, confounding exploitation of any predictive indications.