Can diversification across economic states improve portfolio performance? In their November 2020 paper entitled “Investing Through a Macro Factor Lens”, Harald Lohre, Robert Hixon, Jay Raol, Alexander Swade, Hua Tao and Scott Wolle study interactions between three economic “factors” (growth, defensive/U.S. Treasuries and inflation) and portfolio building blocks (asset classes and conventional factor portfolios). Their proxies for economic factors are: broad equity market for growth; U.S. Treasuries for defensive; and, spread between inflation-linked bonds and U.S. Treasuries for inflation. To diversify across economic states, they calculate historical performance of each portfolio building block during each of four economic regimes: (1) rising growth and rising inflation; (2) rising growth and falling inflation; (3) falling growth and rising inflation; and, (4) falling growth and falling inflation. They then look at benefits of adding defensive and inflation economic factor overlays to a classis 60%/40% global equities/bonds portfolio. Using monthly economic factor data and asset class/conventional factor portfolio returns during February 2001 through May 2020, they find that:

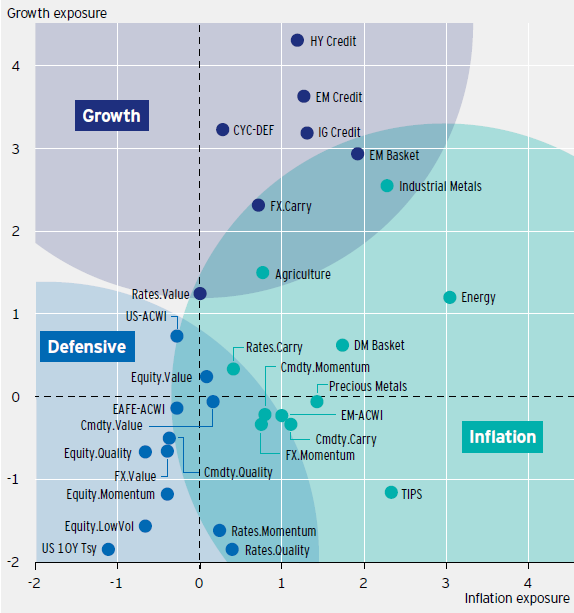

- Based on full sample data, quintessential growth, defensive and inflation assets are high-yield bonds/credit, 10-year U.S. Treasury notes and energy, respectively. Baskets of economic factor assets/conventional factor portfolios include (see the chart below):

- Growth – Credit, cyclical sectors, emerging market currencies, rates value and currency carry.

- Defensive – U.S. Treasuries, quality factors, equity momentum and equity low-volatility.

- Inflation – TIPS, commodities, commodity carry, currency momentum and rates carry.

- Some assets/conventional factor portfolios relate reasonably to more than one economic factor.

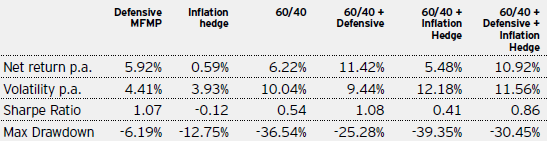

- Adding a defensive economic factor overlay to the classic 60%-40% portfolio offers material benefits in-sample, boosting annualized return and Sharpe ratio and suppressing maximum drawdown (see the table below).

- Adding an inflation economic factor overlay to the classic 60%-40% portfolio is not attractive in-sample (again, see the table below).

The following chart, taken from the paper, maps various asset classes/conventional factor portfolios onto economic factors (shaded regions) based on full-sample data. Some asset classes/conventional factor portfolios clearly belong in one economic factor region, while others fall into two.

The following table, extracted from the paper, summarizes (in-sample) effects of adding defensive and inflation macroeconomic factor-mimicking portfolios (MFMP) to the classic 60%/40% equities/bonds portfolio in U.S. dollars during January 2006 through May 2020. The defensive overlay is attractive, but the inflation hedge overlay is not.

In summary, evidence suggests that adding a defensive economic factor overlay to a classis stocks/bonds portfolio improves overall performance.

Cautions regarding findings include:

- Based on definitions used, calling economic conditions “factors” is confusing.

- The sample period is short in terms of number of economic/market cycles and secular economic trends.

- Modeling is in-sample, thereby incorporating look-ahead bias into findings. In other words, results represent perfect foresight of asset/factor performance over the sample period, and investors should not expect to achieve the reported level of improvement.