Does Bitcoin behave like some other asset class? To investigate, we use the easily held, liquid and matched-close Grayscale Bitcoin Trust (GBTC) as a proxy for Bitcoin holdings and calculate daily and monthly return correlations between GBTC and each of 35 exchange-traded products encompassing those used in “Simple Asset Class ETF Momentum Strategy ” (SACEMS), 22 others considered in “SACEMS Portfolio-Asset Addition Testing” plus SPDR Bloomberg Barclays 1-3 Month T-Bill (BIL), iShares 1-3 Year Treasury Bond (SHY) and Powershares DB US Dollar Index Bullish Fund (UUP). These selections represent a broad set of asset classes. We start calculations with inception of GBTC on May 11, 2015. All other assets are available as of that date. Using daily and monthly levels of Bitcoin and prices for GBTC and the 35 other exchange-traded products adjusted for dividends and splits during mid-May 2015 through late November 2020, we find that:

Over the full sample period, GBTC has average monthly return 8.7% with standard deviation 24.1%, suggesting an immature cryptoasset market. Its correlation of monthly (daily) returns with Bitcoin itself is 0.82 (0.68).

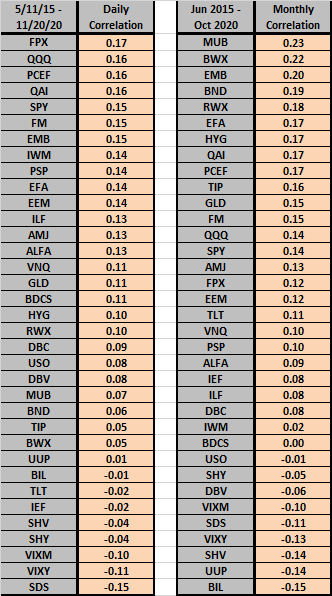

The following tables summarize daily (left table) and monthly (right table) correlations between GBTC returns and returns for each of the other 35 exchange-traded products over the full sample period. Each table lists products from highest (most positive) to lowest (most negative) correlations. Notable findings are:

- GBTC exhibits no strong interactions with any other assets.

- There are many inconsistencies in daily and monthly correlation ranks.

- The most consistent indications are modestly negative correlations with equity market volatility.

In summary, evidence from available data suggests Bitcoin over the past five years is not much like any other asset class.

Cautions regarding findings include:

- The available sample period is short in terms of variety of economic conditions.

- As noted, GBTC price fluctuations are dramatic, reflecting market immaturity that may confound reliable inference.

- As noted by the offeror and confirmed by correlations, GBTC does not exactly track Bitcoin due to costs of maintaining a liquid fund, fees and different supply and demand dynamics.

- The above correlations measure linear relationships only.

See other relevant research summaries via this search.