Can currency carry traders improve performance by excluding “bad” currencies? In the April 2015 version of their paper entitled “Good Carry, Bad Carry”, Geert Bekaert and George Panayotov investigate the differences between good and bad carry trades (long high-yield and short low-yield) constructed from G-10 currencies. They define good (bad) trades as those with relatively high (low) Sharpe ratios and slightly negative or positive (more negative) skewness. Their benchmark portfolio is long (short) the equally weighted five G-10 currencies with the highest (lowest) yields. Their process for dynamically and progressively enhancing the currency carry trade universe is to isolate currencies associated with bad carry trades by each month: (1) experimentally excluding currencies one at a time from the benchmark and dropping the one that most depresses inception-to-date Sharpe ratio (inception December 1984); and, (2) repeating until they have eliminated seven currencies. The number of long positions is equal to the number of short positions in all test portfolios, with positions equally weighted. Monthly performance calculations are net (exploiting availability of bid and ask quotes). Using one-month forward quotes on the last trading day of each month and spot quotes on the last day of the next month for all G-10 currencies during December 1984 through June 2014 (354 months), they find that:

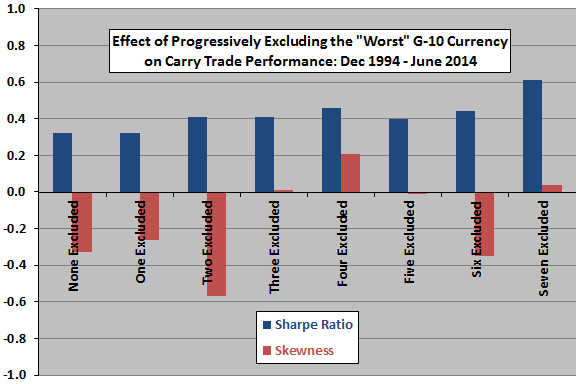

- Carry trade net Sharpe ratio and return skewness generally, but not smoothly, increase as the number of currencies excluded due to association with bad carry trades increases (see the chart below).

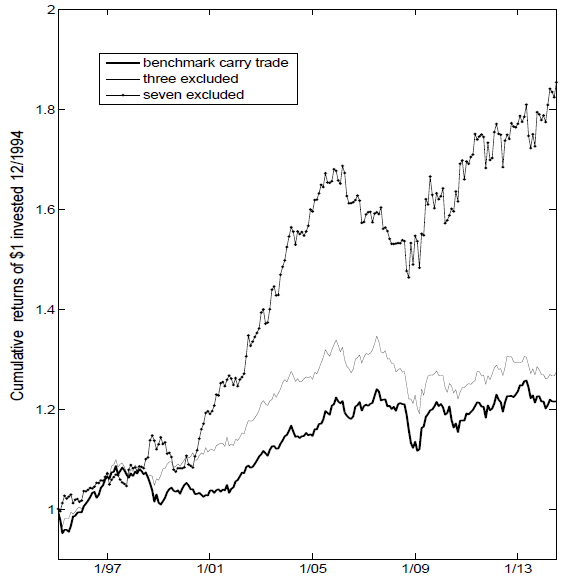

- However, there is an extended subperiod when exclusion of currencies associated with bad carry trades does not work (see the second chart below).

- The currencies most frequently excluded by the universe enhancement process are the Australian dollar, the Norwegian krone and Japanese yen. Those least frequently excluded are the U.S. dollar (never excluded) and the Great Britain pound.

- Returns of good carry trades relate more strongly to interest rates and equity market risk factors than do returns of bad carry trades.

The following chart, constructed from data in the paper, shows the net annualized Sharpe ratio and skewness of monthly returns for eight carry trade portfolios that progressively (left to right) exclude more currencies from the universe as described above. In general, net Sharpe ratio and return skewness are higher for narrower than broader universes. However, the trends are not completely systematic, undermining strong belief in the enhancement process.

The next chart, taken from the paper, shows cumulative net values of $1 initial investments in the benchmark carry trade (no currencies excluded) and in carry trades for two dynamic currency universes enhanced as described above (three or seven currencies excluded). The enhanced universes dominate the benchmark in the first half of the sample period. However, during 2005 through 2008, the enhanced universes underperform the benchmark, particularly the most restricted universe. After 2008, the most restricted universe resumes outperformance.

In summary, evidence suggests that currency carry traders may be able to boost performance by dynamically excluding from consideration currencies associated with past bad trades.

- Iterative testing of strategy variations on the same data introduces data snooping bias, such that the best variation likely overstates expected performance.

- As suggested by the cumulative performance chart, excluding assets from a universe may reduce the resilience of a strategy to unusual conditions. In other words, the assets that work best for a particular unusual condition may not help most of the time, and are therefore excluded from consideration when most needed.

For a somewhat similar approach in s different setting, see “Simple Asset Class ETF Momentum Strategy Universe Sensitivity”.