Does low volume in currency exchange markets expose exploitable inefficiencies? In their August 2017 paper entitled “The Value of Volume in Foreign Exchange”, Antonio Gargano, Steven Riddiough and Lucio Sarno investigate whether currency trading volumes (including spot, swap and forward) exploitably predict currency returns. They first measure interactions of trading volumes and returns statistically. They then assess gross economic import via portfolios formed from daily double-sorts first on prior-day returns and then on prior-day trading volumes, focusing on a portfolio that is each day long (short) currency pairs with low (high) prior returns and low trading volumes. Finally, they incorporate bid-ask spreads to determine whether net portfolio performance is attractive. Using hourly spot, swap and forward trading volumes and their daily returns across 31 currency pairs during November 2011 through December 2016, they find that:

- Past volume alone does not predict currency trading returns.

- However, past volume in combination with past return does predict currency trading returns. Specifically:

- When volume is lower, past returns tend to reverse more strongly.

- The effect is consistent across currency pairs, strongest for spot trading and weakest for swap trading.

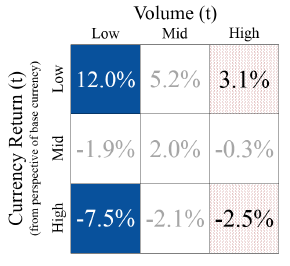

- Based on daily double sorts of currency pairs (all three types) first into thirds by prior-day returns and then within each returns third into thirds based on prior-day trading volumes (see the figure below):

- A hedge portfolio that is each day long (short) currency pairs with the lowest (highest) returns and the lowest prior-day volumes generates gross annualized return 19.5% and gross annual Sharpe ratio 1.8, with maximum drawdown -9%.

- A hedge portfolio that is each day long (short) the currency pairs with the lowest (highest) return and the highest prior-day volumes generates gross annualized return 5.6% and gross annual Sharpe ratio 0.46, with maximum drawdown -19%.

- Return-volume portfolio effects are stronger for spot and forward trading than for swap trading.

- After accounting for realistic bid-ask spreads, net annualized return to the above high-performing hedge portfolio remains attractive (13.1%) and highly statistically significant.

- Sensitivity tests indicate that volume-return interaction trading is:

- Net profitable when rebalancing at all times during the trading day except the lowest liquidity hours when only the Australian market is open and bid-ask spreads are widest.

- Works for only a few hours after the time when past volumes and returns are measured.

- Is robust to using double sorts with two return baskets and four volume sub-baskets, and with three return baskets and four volume sub-baskets.

- Volume-return interaction returns are uncorrelated with those of carry and momentum strategies and therefore a potential diversifier.

The following illustration, taken from the paper summarizes gross annualized returns for nine long portfolios reformed daily by sorting all currency pairs first into thirds by prior-day returns and then sorting each returns third into further thirds by prior-day trading volumes. For example, gross annualized return for:

- The portfolio of low-return/low-volume currency pairs is 12.0%.

- A hedge portfolio that is long low-return/low-volume currency pairs and short high-return/low-volume currency pairs is 19.5%.

In summary, evidence indicates that currency pairs exhibiting low trading volumes exhibit exploitably amplified daily return reversals.

Cautions regarding findings include:

- The sample period is short in terms of variety of economic and currency exchange market conditions.

- As noted in the paper, the trading volumes used in the study account for only 30%-50% of currency trading market volumes.

- Currency trading volume data not freely available. Costs associated with acquiring the data would reduce reported returns.

- Daily strategy execution is beyond the reach of most investors, who would bear fees for delegating to an investment manager.