How are attitudes toward Bitcoin as an investment evolving? In their October 2020 survey report entitled “Comparing Public Bitcoin Adoption Rates in 2020 vs 2017”, the Tokenist summarizes findings from a survey using the same questions as three of the most widely cited past surveys on Bitcoin adoption from October 2017, July 2018 and April 2019. Respondents to the new survey include 4,111 via an online multiple choice questionnaire and conducted via Google Surveys and 741 via an email campaign to Tokenist readers. Using data from these 4,852 respondents received September-October 2020 and results of the past surveys, they find that:

- Respondents to the new survey span 17 countries and ages 18-65+. Over 43% of respondents are in age range 25-35.

- 61% (78%) of all (millennial) respondents are now somewhat familiar with Bitcoin, and 14% of millennials have owned the asset.

- 60% of respondents view Bitcoin as a positive innovation in financial technology, an increase of 27% over past surveys.

- 47% of respondents trust Bitcoin over big banks, an increase of 29% over past surveys.

- 44% of millennials expect to buy Bitcoin in the next five years.

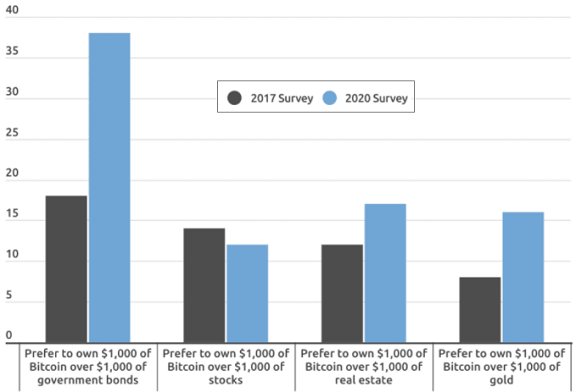

- Over 45% of respondents prefer Bitcoin to stocks, real estate and gold, versus 34% in prior surveys (see the chart below).

- 13% say Bitcoin is the best way to invest money not needed for the next 10 years, versus 2% in prior surveys.

The following chart, taken from the survey report, summarizes head-to-head preferences among all respondents for Bitcoin over government bonds, stocks, real estate and gold from 2017 and 2020 surveys.

In summary, survey results suggest a favorable shift in attitude toward Bitcoin as an investment asset.

Cautions regarding findings include:

- Due to the survey methodology, no statistical sampling error can be calculated.

- The concentration of respondents in age range 25-35 indicates the sample is not representative of the dollar-weighted investor community.

- Survey responses may not reflect actual investment actions.

See results of this search for other Bitcoin research.