Should investors consider adding crypto-assets to portfolios of traditional assets? In their April 2018 paper entitled “Cryptocurrencies as an Asset Class?”, Sinan Krueckeberg and Peter Scholz investigate whether cryptocurrencies (crypto-assets) qualify as a distinct asset class, attractively diversifying portfolios of traditional asset classes. They distinguish between cryptographic coins (with their own blockchains) and tokens (using third party blockchains). They focus on the 10 coins and tokens with the largest market capitalizations as of December 8, 2017 that have at least three months of prices. Their investigation involves:

- Computing three types of pairwise correlations between crypto-assets and between crypto-assets and traditional assets to measure crypto-asset uniqueness.

- Comparing trading volumes and ratios of trading volume to market capitalization to those for several large stocks to assess liquidity.

- Measuring frequencies of crypto-asset market circuit breaker trips and limit up/down triggers to assess stability.

- Adding crypto-assets to traditional portfolios with quarterly rebalancing to test impact on Sharpe ratio with ex-post (perfect foresight) optimization and three approaches to ex-ante allocation (the simplest a fixed 1% allocation to crypto-assets). Traditional portfolios consist of stocks and bonds, plus (progressively) real estate, gold and oil.

Using daily price data for the top 10 coins/tokens and for traditional asset class proxies, and tick-by-tick crypto-asset price data to assess stability, during late April 2013 through early November 2017, they find that:

- Based on correlation analyses, crypto-assets are a distinct asset class. In general, there are strong correlations between crypto-assets and near zero correlations between crypto-assets and traditional assets.

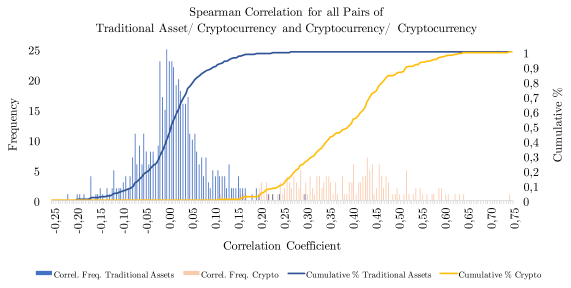

- Using Spearman correlations, only 18 of 520 crypto-traditional asset pairs have significantly non-zero correlations (see the chart below).

- Based on all three types of correlations, only five of 520 crypto-traditional asset pairs have significantly non-zero correlations.

- Moderate correlations between coins and tokens support the idea of two crypto-asset sub-classes.

- Trading volumes for some crypto-assets are comparable to those for large stocks. Volume-to-market capitalization ratios are higher for crypto-assets than for large stocks.

- Bitcoin (about two thirds of total crypto-asset market capitalization) is rather unstable, with 92 market circuit breaker trips during 2016-2017.

- Regarding potential portfolio diversification benefits of crypto-assets:

- Adding ex post quarterly optimized crypto-asset allocations to portfolios of traditional assets reliably improves Sharpe ratios but does not reduce portfolio volatility.

- Two of three ex-ante quarterly portfolio allocation methods adding crypto-assets improve performances of portfolios of traditional assets, including a simple 1% allocation to crypto-assets.

The following chart, taken from the paper summarizes frequency and cumulative distributions of Spearman daily return correlations for crypto-traditional asset pairs (blue) and for crypto-crypto asset pairs (yellow). Results indicate that crypto-assets are largely unrelated to traditional assets but moderately related to each other.

In summary, available evidence indicates that investors may benefit from adding crypto-assets to their portfolios, with even a fixed 1% allocation offering material Sharpe ratio improvements.

Cautions regarding findings include:

- Return histories of crypto-assets are immature and may not be representative of their future return distributions.

- The sample period is extremely short in terms of variety of market conditions for both traditional asset classes and, especially, for immature crypto-assets.

- Backtesting multiple ex ante crypto-asset allocation schemes on the same data introduces snooping bias, such that the best-performing scheme overstates expectations.

See also the recent “Crypto-asset Research Survey” (with multiple links at the end).