Bitcoin is a currency based on cryptographic proof rather than traditional trust, with transactions taking place directly between users and recorded in a distributed public ledger. How wild is the exchange rate for this new form of currency? In their November 2016 paper entitled “A Statistical Risk Assessment of Bitcoin and Its Extreme Tail Behaviour”, Joerg Osterrieder and Julian Lorenz examine the recent distribution of daily Bitcoin-U.S. dollar exchange rate returns, with focus on tail risk metrics. They also compare Bitcoin exchange rate return statistics to those for G10 currencies versus the U.S. dollar. Using daily Bitcoin Baverage and G10 currency exchange rates relative to the U.S. dollar during September 2013 through September 2016, they find that:

- Relative to the U.S. dollar, Bitcoin exchange rate return volatility is about six to seven times those of G10 currencies. However, its volatility decreases over time, from almost 200% annualized during its early years to lows of 20% to 30% in 2016.

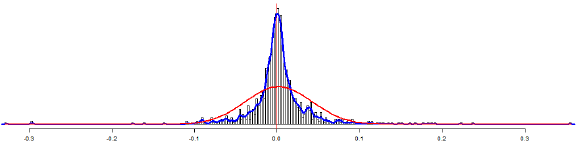

- The Bitcoin exchange rate daily return distribution is more strongly non-normal and has heavier tails than those of G10 currencies (see the chart below).

- Value at risk is about five times larger for Bitcoin exchange rate daily returns than for G10 currency exchange rate returns. Specifically, a Bitcoin holder should expect to lose more than 5% versus the U.S. dollar about one day out of 20.

- Expected shortfall is about eight times larger for Bitcoin exchange rate daily returns than for G10 currency exchange rate returns. Specifically, the average Bitcoin loss versus the U.S. dollar for those one-in-20 worst days is about 10%.

The following chart, taken from the paper, compares:

- A distribution fitted to a histogram of daily returns for the Bitcoin-U.S. dollar exchange rate (blue curve).

- A normal distribution with the same average daily return and same standard deviation of daily returns (red curve).

The blue curve is highly non-normal with relatively many extreme returns.

In summary, evidence shows that the recent distribution of daily Bitcoin-U.S. dollar exchange rate returns exhibits much higher volatility, much more pronounced non-normality and much heavier tails than distributions for G10 currencies exchange rates.

Cautions regarding findings include:

- As noted in the paper, Bitcoin is a relative new currency, and its exchange rate volatility decreases over time.

- Bitcoin exchange rates may be highly susceptible to political interference.

- Bitcoin may be illiquid compared to traditional currencies.

See also “Stash Some Cash in Bitcoins?”.