How profitable is automated multi-horizon extraction of liquidity premiums in currency exchange markets? In their April 2017 paper entitled “The Alpha Engine: Designing an Automated Trading Algorithm”, Anton Golub, James Glattfelder and Richard Olsen introduce an adaptive counter-trend algorithmic trading system that seeks liquidity premiums from price series via automated trades at adaptive market events. The system consists of the following building blocks:

- Module that employs an event-based (intrinsic) time scale to determine price series directional changes and overshoots.

- Module that analyzes relationships between price series directional changes and overshoots over multiple (baseline four) horizons.

- Module that sorts directional changes (upward or downward) to enable asymmetric overshoot thresholds.

- Module that trades at empirically adaptive events.

- Module that sizes trades by identifying degrees to which associated market conditions are abnormal.

- Module that suppresses accumulation of large inventories during long market trends.

For opportunity generation and execution, they require: intraday trading capability; full automation; and, limit orders (to the extent possible). They illustrate the system on currency trading. Using intraday data for 23 currency exchange rates during 2006 through 2013, they find that:

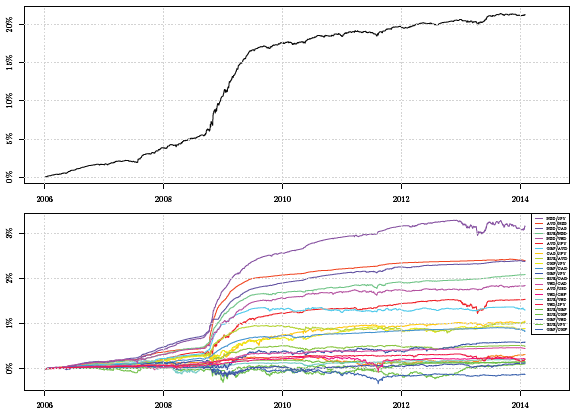

- Averaged across currency pairs, the trading system generates annualized gross return 21.3%, with gross annual Sharpe ratio 3.1 and maximum drawdown (based on daily closes) 0.71%. This drawdown occurs in early 2013 and lasts about four months (see the first chart below).

- Gross performance varies considerably across currency pairs (see the second chart below). High-volatility exchange rates produce more events and hence more opportunities to extract a liquidity premium from the market than do low-volatility exchange rates.

- With leverage factor 10, the system generates average gross annual return 10%, with maximum drawdown 7.1%, over the last four years of the sample period.

- Tweaking the system has great potential to improve its performance.

- The system generates a gross profit even on a random walk price series, because such a series exhibits mean reversion of streaks.

The following charts, taken from the paper, plot gross performance of the trading system averaged across all exchange rates (upper chart) and as applied to each exchange rate separately (lower chart) over the sample period. In aggregate, profitability concentrates during the 2008-2009 financial crisis. For individual exchange rates, profitability relates positively to price series volatility.

In summary, evidence from testing on currency exchange rates indicates that the automated multi-horizon, counter-trend trading system reliably and smoothly extracts a gross liquidity premium for volatile exchange rates.

Cautions regarding findings include:

- Performance results are gross, not net. Accounting for trading frictions, which vary by asset class and market, would reduce these results. The authors do not address trade frequency, but do note that frequency (and therefore frictions) increase with gross profitability.

- In discussing leverage, the authors assume zero associated costs/conditions.

- As shown in the charts above, gross profitability of the system concentrates under extremely unusual conditions during a fairly short subperiod (the 2008-2009 financial crisis).

- Though the authors assert that they refrained from “tweaking” the system to improve backtest performance, there may be snooping bias inherited from their past experiences and prior research.