Do behaviors of commodity futures over the past decade require updating of beliefs based on earlier research? In their August 2015 paper entitled “Conquering Misperceptions about Commodity Futures Investing”, Claude Erb and Campbell Harvey update and interpret research on returns from a passive, continuous investment in commodity futures. They focus on:

- Relative contributions of price return and income components, with the latter comprised of roll return (switching from expiring to newer contracts) plus collateral return (cash deposits).

- Whether or not commodity futures represent an asset class.

- Whether passive commodity futures investment performance is comparable to that of passive investment in stocks.

Based on 1970 through 2004 research and an update spanning December 2004 through June 2015 focused on S&P GSCI returns, they find that:

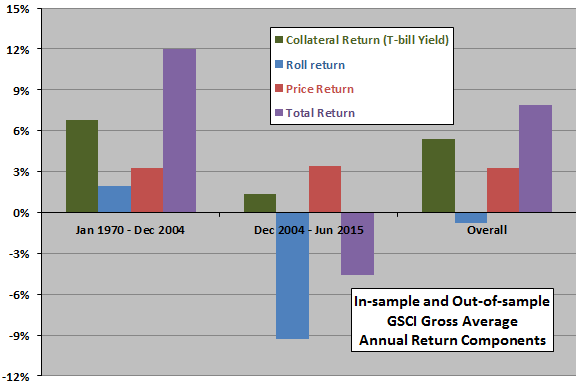

- Income returns, not price returns, appear to dominate long‐term total returns of a diversified commodity futures portfolio (see the first chart below).

- During 1970-2004 the S&P GSCI has average annual total return 11.9%, comprised of 8.7% income return and 3.2% price return.

- During 2005-June 2015, average annual total return is ‐4.6%, comprised of -8.0% income return and 3.4% price return.

- The -16% swing in average annual income return drives the change in average total return.

- Analysis of commodity futures valuations is confounding:

- Over the combined sample period, the inflation-adjusted (real) S&P GSCI trends downward. In other words, the real value of commodity futures tends to fall over time.

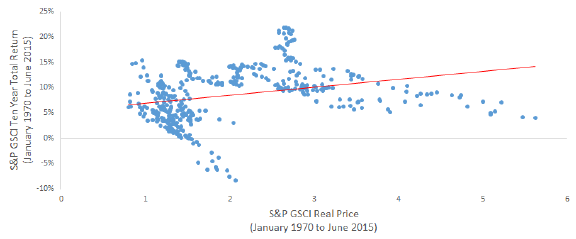

- The real S&P GSCI relates positively to future 10-year S&P GSCI total returns. In other words, the lower the real S&P GSCI, the lower the subsequent total return (see the second chart below).

The following chart, constructed from data in the paper, decomposes average annual S&P GSCI total returns into collateral returns, roll returns and price returns during 1970-2004, 2005-June 2015 and overall. Results suggest that income return, especially its roll return component (a consequence of term structure, differences in prices across contracts with different expirations), varies considerably and drives total return.

The next chart, taken from the paper, relates future 10-year gross annualized S&P GSCI total return to real S&P GSCI over the combined 1970-June 2015 sample period. The upward slope of the best-fit line suggests that a higher (lower) real value for the index means a higher (lower) future total return.

In summary, evidence suggests that over the long term commodity futures income return (as driven by term structures) swamps price return, such that insights about commodity valuations have little use.

Cautions regarding findings include:

- The sample period (about 4.5 independent 10-year intervals) is very short for analysis of 10-year returns.

- Analyses are gross, not net. Accounting for the costs of rolling contracts to maintain continuous positions in futures contract series would reduce reported returns.

- Analyses do not address the value of commodity futures as portfolio diversifiers.