It is plausible that crude oil as a dominant energy commodity has return characteristics substantially different from those of other commodities and asset classes, and therefore represents a good diversification opportunity. To check, we add the United States Oil Fund (USO) to the following mix of asset class proxies (the same used in “Simple Asset Class ETF Momentum Strategy”):

PowerShares DB Commodity Index Tracking (DBC)

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI EAFE Index (EFA)

SPDR Gold Shares (GLD)

iShares Russell 1000 Index (IWB)

iShares Russell 2000 Index (IWM)

SPDR Dow Jones REIT (RWR)

iShares Barclays 20+ Year Treasury Bond (TLT)

3-month Treasury bills (Cash)

First, per the findings of “Asset Class Diversification Effectiveness Factors”, we measure the average monthly return for USO and the average pairwise correlation of USO monthly returns with the monthly returns of the above assets. Then, we compare cumulative returns and basic monthly return statistics for equally weighted (EW), monthly rebalanced portfolios with and without USO. We ignore rebalancing frictions, which would be about the same for the alternative portfolios. Using adjusted monthly returns for USO and the above nine asset class proxies as available from May 2006 (first return available for USO) through April 2013 (84 monthly returns), we find that:

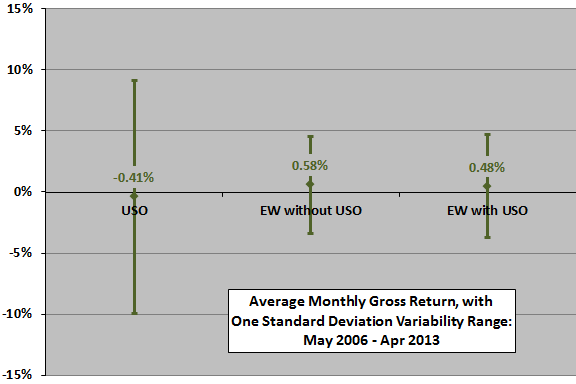

The following chart summarizes average monthly returns with variability ranges of one standard deviation for USO and the EW portfolios without and with USO over the available sample period. During this time, USO generates a weak average return and high volatility compared to EW without USO. Adding USO to the diversified EW portfolio marginally reduces return and increases volatility. The ratio of average return to standard deviation (return per unit of risk) is 0.15 (0.11) without (with) a USO position.

The average pairwise correlation of USO monthly returns with those of the other assets is a relatively high 0.37 over the available sample period. Correlation with DBC is a notably high 0.87.

Per “Asset Class Diversification Effectiveness Factors,” the poor average return (middling average pairwise correlation) of USO indicates a poor (indifferent) contribution with respect to portfolio diversification.

Sample size is small in terms of a variety of market conditions.

What is the net result of these effects?

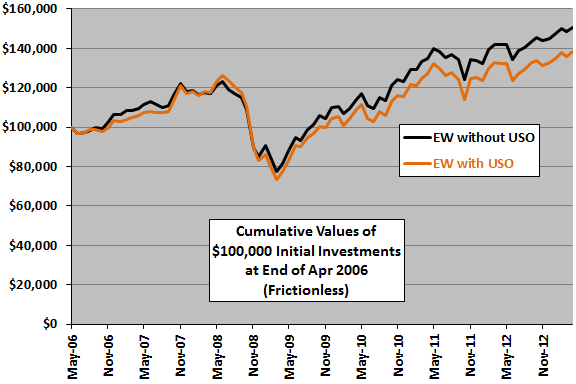

The next chart compares cumulative values of EW portfolios without and with USO in the mix over the available sample period. Adding USO has a mostly negative effect.

Again, sample size is small.

In summary, evidence from simple tests over the available sample period does not support belief that adding a proxy for crude oil to a diversified portfolio (including a broader commodities proxy) improves performance.

It appears that USO largely duplicates the broader commodities position.

Cautions regarding findings include:

- As noted, the sample period is very short in terms of market conditions (one bear market and little variation in base interest rates).

- Including the trading frictions associated with monthly rebalancing would depress performance of both portfolios, depending mostly on portfolio size.