Which asset class best hedges inflation? In the September 2012 draft of his book chapter entitled “‘Real’ Assets”, Andrew Ang examines the behaviors of the following assets commonly thought to hold their value during times of high inflation (“real” assets): inflation-linked bonds, commodities, real estate and U.S. Treasury bills (T-bill). He focuses on inflation as year-over-year change in the U.S. Consumer Price Index for all urban consumers and all items, but considers also inflation rates for medical care and higher education. He distinguishes inflation hedging (measured by correlation of returns and inflation) from long-run asset class performance. Using asset class proxy returns and U.S. inflation rates as available through 2011, he finds that:

- Treasury Inflation-Protected Securities (TIPS) as an asset class are a poor inflation hedge, with correlation between returns and inflation close to zero. Specifically:

- While an individual TIPS bond provides a constant real return by definition, investors generally hold portfolios of TIPS with asset class-like allocation targets.

- The tendency of real yield to fall when inflation rises causes the value of a TIPS portfolio to drop when inflation is high, and real yield can be negative for extended periods.

- During March 1997 through December 2011, the BarCap U.S. TIPS benchmark has a 7.0% average annual return with 5.9% annual standard deviation, but the correlation of returns with inflation is just 0.10. During 2003 through 2011, correlations of the returns of TIPs portfolios with durations of 5, 10 and 20 years with inflation are negative.

- Commodities offer some hedging of inflation only because of energy. Specifically, during January 1986 through December 2011:

- The GSCI has an 8.9% average annual return with 20.7% standard deviation. The correlation of GSCI returns with inflation is 0.29.

- The correlations of overall energy returns and crude oil returns with inflation are 0.26 and 0.23, respectively.

- The correlation of agriculture returns with inflation is -0.04.

- The correlations of overall precious metals returns and gold returns with inflation are 0.02 and 0.01, respectively. Over the much longer period of September 1875 through December 2011, the correlation of annual spot gold returns and inflation is 0.23.

- Real estate offers modest hedging of inflation at long horizons. For example, based on quarterly data from January 1978 through December 2011:

- There are similarities between Real Estate Investment Trust (REIT) returns and a (problematic) measure of physical real estate returns over the long run.

- At short horizons, robust correlations of REIT (FTSE NAREIT All Equity REITs Index) and stock returns with inflation are both around -0.10.

- For horizons longer than a year, correlations of REIT returns with inflation are a little higher than those for stock returns, with the former reaching 0.40 for a five-year horizon.

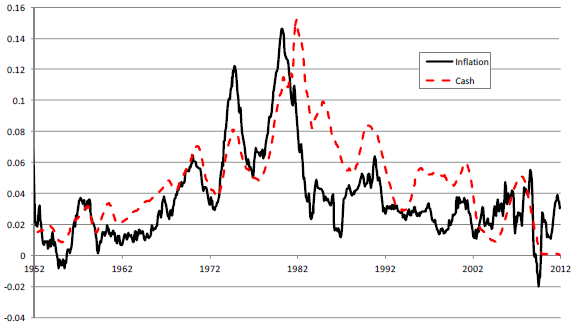

- While inconveniently lagging inflation, cash (earning the T-bill yield) is a very good inflation hedge. Specifically, during 1952 through 2011, T-bills have an average annual return of 4.8%, compared to 3.7% average inflation, with correlation of T-bill returns and inflation at 0.70 (see the chart below).

The following chart, taken from the paper, compares the U.S. inflation rate (Inflation) and the T-bill yield (Cash) during 1952 through 2011. While the T-bill yield tends to lag inflation, it tracks inflation fairly well, and the gap between T-bill yield and inflation is mostly positive.

In summary, evidence indicates that cash (invested in T-bills) is a very good inflation hedge, while real estate and energy commodities are modestly effective. TIPS portfolios and gold are not effective inflation hedges.

Cautions regarding findings include:

- Because it is difficult to assemble samples spanning many inflation cycles, findings may be sensitive to sample periods, which vary considerably across asset types.

- Analyses in the paper generally rely on indexes. Including the costs of creating and maintaining actual assets from these indexes (trading frictions and management fees) would affect returns and may affect findings.