Is platinum as good as gold? In the September 2013 version of their paper entitled “Analysis of the Investment Potential of Platinum Group Metals”, James Ross McCown and Ron Shaw evaluate the investment value of platinum group metals (platinum, palladium, rhodium, iridium, ruthenium and osmium). Using daily spot prices for platinum group metals, gold and crude oil, daily levels of a broad U.S. stock market index, monthly U.S. consumer and producer price indexes and monthly U.S. industrial production levels during July 1992 through December 2011, they find that:

- Over the sample period, annualized returns for platinum group metals, except rhodium, are similar to those for gold, oil and stocks, and well above the 2.5% average inflation rate. All five platinum group metals exhibit higher (lower) daily return volatility than gold (oil).

- Platinum has very high daily price correlations with gold (0.87) and oil (0.96). Platinum prices have a higher daily correlation with U.S. stock market levels than gold (0.53 versus 0.28), suggesting that gold is a better short-term hedge for stocks than platinum. [See cautions below.]

- However, platinum typically has a negative five-year beta relative to the U.S. stock market, suggesting diversification value for long-term equity investors.

- Platinum return relates more strongly to U.S. business conditions (industrial production) than gold return. Platinum and oil price series are very similar, perhaps due to their mutual connections to the automobile industry.

- Platinum returns exhibit higher correlations with U.S. consumer and producer price inflation rates than gold, suggesting that it is a better inflation hedge.

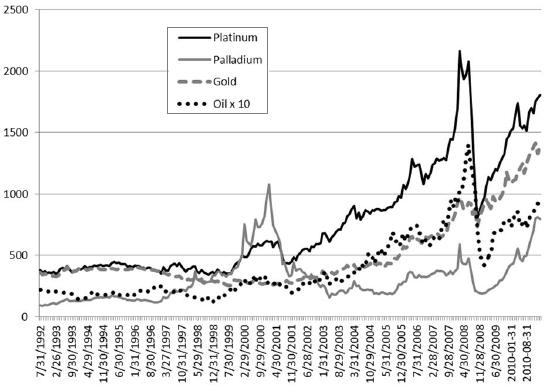

The following chart, taken from the paper, tracks monthly spot prices per troy ounce for platinum, palladium gold and adjusted crude oil price per barrel. Platinum and palladium track oil closely in recent years.

In summary, recent evidence suggests that: platinum prices behave much like those of crude oil; platinum tends to be more stock-like than gold; platinum may be an effective inflation hedge; and, platinum may be an effective long-term diversifier for stocks.

Cautions regarding findings include:

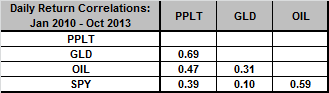

- The daily correlations are for price, not return, series. Because the price series are not stationary (have no stable mean), these correlations are not reliable metrics for assessment of hedging power. The following table summarizes pairwise correlations of dividend-adjusted daily returns among ETFS Physical Platinum Shares (PPLT), SPDR Gold Shares (GLD), iPath S&P GSCI Crude Oil TR Index ETN (OIL) and SPDR S&P 500 (SPY) since inception of PPLT in January 2010. Results do confirm that PPLT tends to be more stock-like than GLD and more strongly related to OIL than GLD.

- The sample period is very short in terms of numbers of independent five-year beta measurements, inflationary regimes and business cycles.

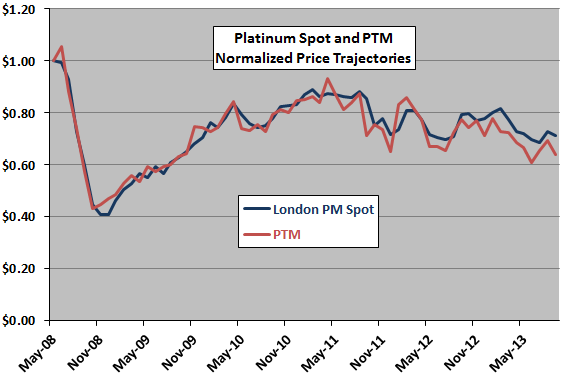

- Prices for tradable forms of platinum metals may behave differently from spot prices. The following chart compares normalized monthly price trajectories for Platinum spot price (London PM fix) and UBS E-TRACS Long Platinum TR ETN (PTM), designed to track an index that models the collateralized returns from platinum futures contracts, since inception of PTM. PTM has a slightly lower average monthly return and a higher standard deviation of monthly returns than spot platinum. These differences could be material for both short-term trading and long-term investments.