Should investors seeking leveraged positions in gold prefer futures or leveraged exchanged-traded funds (ETF)? In their August 2014 paper entitled “Price Dynamics of Gold Futures and Gold Leveraged ETFs”, Tim Leung and Brian Ward compare the price evolutions of spot gold, gold futures and leveraged gold ETFs. They use the XAU-USD gold-U.S. dollar exchange rate as the spot gold price. Among gold futures, they consider maturities from nearest month to one year. Among ETFs, they consider the unleveraged iShares GLD, the ProShares 2X UGL, the ProShares -2X GLL, the VelocityShares 3X UGLD and the VelocityShares -3X DGLD. They also construct static and dynamic portfolios of gold futures in efforts to replicate spot gold and leveraged gold price behaviors. Using recent gold futures and gold ETF prices through 7/14/2014, they find that:

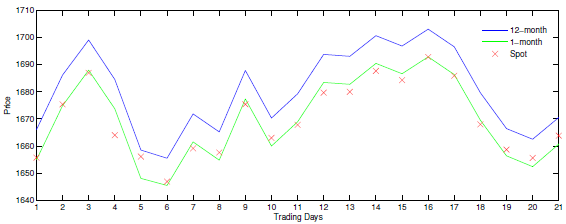

- Gold futures contracts of different maturities exhibit strong price co-movement with spot gold and among each other (see the first chart below), with the actively traded nearest-term contract closely tracking spot gold price.

- Linear regression of daily returns suggests that futures returns are a little less volatile than spot return, but annual volatilities of futures are in fact somewhat higher (19.3% for nearest term versus 18.4% for spot).

- The longer the holding interval, the more closely futures track spot gold.

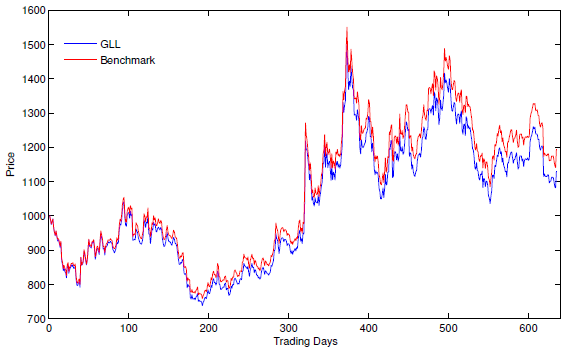

- Linear regression shows that leveraged gold ETFs perform as advertised on a daily basis, with long funds generally tracking a little better than short funds. However, as holding interval lengthens, leveraged ETFs tend increasingly to underperform appropriate benchmarks, particularly when volatility is high (see the second chart below). Long and short leveraged ETFs sometimes exhibit negative cumulative returns at the same time when held over a long interval.

- A static portfolio consisting of one or two futures series with different maturities plus collateral, rolled as contracts expire, closely tracks spot gold.

- For tracking leveraged gold benchmarks, dynamic leveraged portfolios of nearest-term futures plus co-varying collateral, recalculated daily, outperform the corresponding leveraged ETFs.

The following chart, taken from the paper, shows the evolution of spot gold price, the nearest-term futures price (Jan-13 contract) and the 12-month futures price (Dec-13 contract) during December 29, 2012 through January 29, 2013. The three series move together, and the nearest-term contract tracks spot gold price closely.

The next chart, also from the paper, shows the evolution of GLL (-2X leveraged gold ETF) and a simple -2x benchmark during 1/3/2012 through 7/14/2014. GLL tends to underperform the benchmark, and the underperformance tends to grow as the holding interval lengthens. Other leveraged gold ETFs exhibit similar behavior.

In summary, evidence suggests that futures contracts may be more effective than leveraged ETFs for taking leveraged positions in spot gold.

The underperformance of leveraged gold ETFs is similar to that observed for many other leveraged ETFs.

Cautions regarding findings include:

- Calculations for futures do not include costs of buying and selling contracts to roll from expiring contracts or to replicate leveraged spot gold price via dynamic adjustments. These costs would reduce returns to replication strategies, especially to the dynamic strategy with daily position adjustments. Effects of dynamic strategy trading frictions may be comparable to leverage ETF underperformance.

- Testing multiple replication schemes for spot gold and leveraged spot gold using different combinations of futures contracts introduces snooping bias, such the the best-performance combination likely overstates tracking accuracy.