Has crude oil turned into paper from an investment perspective? In their May 2013 paper entitled “Oil Prices, Exchange Rates and Asset Prices”, Marcel Fratzscher, Daniel Schneider and Ine Van Robays examine relationships between crude oil price and behaviors of other asset classes. Specifically, they relate spot West Texas Intermediate (WTI) crude oil price to: the U.S. dollar exchange rate versus a basket of developed market currencies; Dow Jones Industrial Average (DJIA) return; U.S. short-term interest rate; the S&P 500 options-implied volatility index (VIX); and, open interest in the NYMEX crude oil futures (as an indication of financialization of the oil market). They also test the response of crude oil price to economic news. Using daily data for these financial series during January 2001 through mid-October 2012, and contemporaneous U.S. economic news and associated expectations, they find that:

- Unlike the other series, crude oil price generally does not respond directly to U.S. economic news.

- Since the end of 2000, shocks to the U.S. dollar exchange rate affect crude oil price, and vice versa. For example:

- A 1% decline in the U.S. dollar causes a 0.73% increase in crude oil price.

- A 10% increase in crude oil price causes a 0.28% decline in the U.S. dollar.

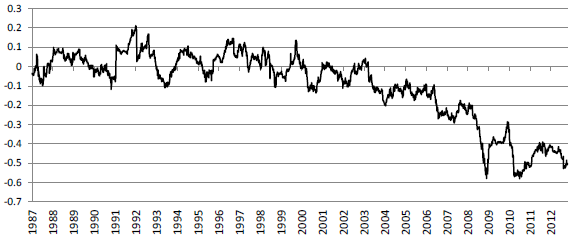

- This daily two-way causal link does not exist before 2001 (see the chart below).

- Since the end of 2000, shocks to DJIA return and VIX affect both oil prices and the U.S. dollar exchange rate.

- A 1% DJIA return relates to a 0.7% increase in crude oil price.

- An increase in VIX reduces crude oil price and boosts the U.S. dollar. During intervals of high volatility, VIX shocks account for about 13% of variations in crude oil price and U.S. dollar exchange rate.

- Crude oil price does not react to DJIA return and change in VIX before 2001.

- Since the end of 2000 (but not before 2001), an increase in the number of open crude oil futures contracts relates to an increase in crude oil price.

The following chart, taken from the paper, shows the 12-month rolling correlation between change in U.S. dollar exchange rate and change in WTI crude oil price during January 1986 through mid-October 2012. Data suggest that the two series become linked in an increasingly negative relationship about the end of 2000.

In summary, evidence suggests that increased use of crude oil as a financial asset over the past decade has intensified its linkages with the U.S. dollar and equities.

Results have implications both for trading and for portfolio diversification with energy commodities.

Cautions regarding findings include:

- The study explores no trading strategies to exploit any findings of causality.

- The study uses spot crude oil price. Trading involves crude oil futures contract prices (or exchange-traded products linked to such contracts), which incorporate trader expectations and may therefore behave differently. (For example, see “Exploit Short-term VIX Reversion with VXX?”.)