Can investors rely on the power of commodity futures to diversify equities, or have growth in industrial hedging and general financialization of commodities permanently changed correlations? In the November 2011 version of their paper entitled “Correlation in Commodity Futures and Equity Markets Around the World: Long-Run Trend and Short-Run Fluctuation”, Xiao-Ming Li, Bing Zhang and Zhijie Du explore the question of whether recent increases in commodities-stocks correlations are transitory. Specifically, they decompose these correlations across equity markets worldwide into two components: long-run trend, and short-run deviation-from-trend. They apply a “best practices” dynamic conditional correlation model to estimate time-varying return correlations, with additional tests to detect structural breaks in long-run trends. Using daily levels of the Goldman Sachs Commodity Index (GSCI) to represent commodities and 45 country stock market indexes (24 developed and 21 emerging) during 2000 through 2010, they find that:

- Over the entire sample period, commodities-stocks return correlation are significantly positive for all 24 developed equity markets, ranging from 0.10 (Israel) to 0.40 (Canada). Diversification benefits from commodity futures relative to stock portfolios weaken substantially after 2007:

- Before the financial crisis (2000-2007), return correlations are relatively low, ranging from -0.01 (U.S.) to 0.18 (Canada).

- During 2008-2010, all 24 return correlations increase considerably, ranging from 0.14 (Japan) to 0.62 (Canada).

- Correlation with the Canadian equity market is always the highest, followed by that for the Norwegian market.

- While commodities-stocks correlations increase significantly for both developed and emerging markets after 2007, increases for the latter are relatively less.

- Regarding long-run trends in commodities-stocks correlations:

- 32 of 45 equity markets exhibit upward long-run trends during 2000-2010. In other words, an upward trend is evident before the 2008 financial crisis.

- 43 of 45 equity markets exhibit sharp increases in long-run trends (structural breaks) with the onset of the 2008 financial crisis.

- 26 of 45 equity markets exhibit a second upward structural break in long-run trends well after onset of the financial crisis, perhaps due to a surge of investment in commodity index proxies.

- Commodities-stocks correlations for 39 of 45 equity markets tend to increase with short-run stock market volatility. In other words, diversification benefits of commodities systematically weaken when most needed.

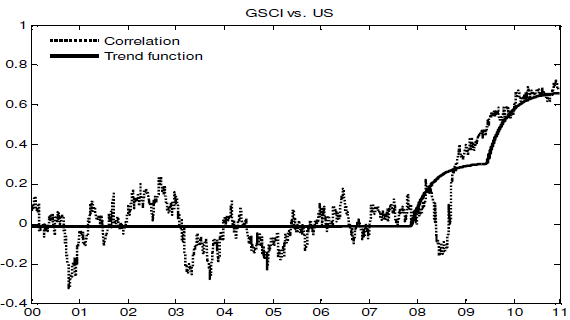

The following chart, taken from the paper, plots the conditional correlation and long-run trend in correlation between GCSI and U.S. equities over the entire sample period. For the U.S. equity market, the commodities-stocks correlation is close to zero and trendless up to 2008. It then exhibits an upward structural break, introducing a positive but fading trend. A second upward structural break in mid-2009 re-accelerates the fading trend from the first break. The result at the end of 2010 is an arguably persistent positive correlation.

The paper presents comparable charts for the other 44 country equity markets.

In summary, evidence from equity markets worldwide indicates that: (1) the decrease in commodity futures diversification benefits relative to stocks is pervasive and may be persistent; and, (2) short-term increases in commodities-stocks correlations during times of high equity market volatility further dent diversification benefits.

Findings suggest inherent limitations on strategic allocation via correlation: (1) different look-back intervals may indicate very different asset allocations; (2) correlations can shift quickly relative to investment horizon; and, (3) broad pursuit of low-correlation assets may raise associated correlations. Broad pursuit of low correlations may also produce price bubbles in target assets.

Cautions regarding findings include:

- The method of correlation calculation is fairly complex and thus challenging to replicate.

- Findings for returns of investable index proxies (incorporating portfolio formation frictions/limitations) may differ from those for hypothetical indexes.