Does the latest generation of commodity futures indexes, which systematically exploits both backwardation and contango, outperform its predecessors? In her July 2012 paper entitled “Comparing First, Second and Third Generation Commodity Indices”, Joelle Miffre reviews the evolution of commodity futures indexes and assesses the performance of three groups of these indexes: (1) first generation, which are long-only and generally ignore backwardation and contango; (2) second generation, which are also long-only but attempt to mitigate contango while exploiting backwardation; and, (3) third generation, which are long-short to exploit both backwardation and contango. Using monthly levels of 6 first, 23 second and 9 third generation commodity futures indexes from the end of May 2008 through April 2012, she finds that:

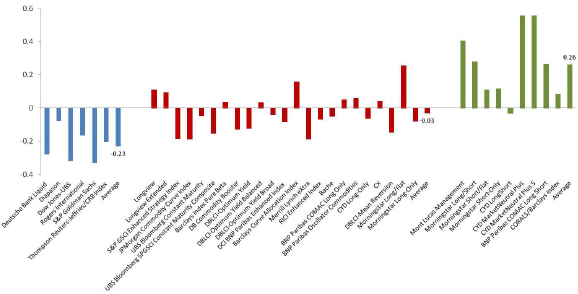

- The first generation of indexes produces an average annualized gross return (in excess of the risk-free rate) of -5.92%, with average annualized gross Sharpe ratio -0.23 (see the chart below).

- The second generation of indexes produces an average annualized gross excess return of -0.93%, with average annualized gross Sharpe ratio -0.03. However, many of these indexes hold distant, relatively illiquid contracts.

- The third generation of indexes produces an average annualized gross excess return of 3.02%, with average annualized gross Sharpe ratio 0.26. Third generation outperformance is pronounced during October 2008 following the Lehman Brothers collapse. These indexes are serious competitors for commodity trading advisors who trade on momentum or term structure.

The following chart, taken from the paper summarizes annualized gross Sharpe ratios of 6 first (blue), 23 second (red) and 9 third (green) generation commodity futures indexes over the period June 2008 through April 2012. Results show that generational enhancements in exploiting backwardation and contango of commodity futures progressively improves average index performance.

The top two indexes over this period are CYD MarketNeutral Plus and CYD MarketNeutral Plus 5.

In summary, evidence from limited data indicates that the latest generation of long-short commodity futures indexes that actively exploit backwardation and contango perform materially better than preceding generations.

Cautions regarding findings include:

- As noted in the paper, the available live sample period is short for reliable inference.

- Converting commodity futures indexes into tradable assets (such as exchange-traded funds or notes) involves trading frictions and management fees that would lower the gross returns reported in the paper. Frictions would be more severe for indexes that use illiquid futures contracts.

- The paper does not address the correlations of returns for different generations of commodity futures indexes with those of other asset classes. Both returns and correlations affect diversification power.