Have investors overwhelmed commercial traders in commodity futures markets, thereby depressing the value of commodity futures as a diversifier of stocks and bonds? In his November 2013 papers entitled “Implications of Financialization for Commodity Investors: The Case of Roll Yields” and “Implications of Financialization for Strategic Asset Allocation: The Case of Correlations”, Adam Zaremba examines the effects of commodity futures market financialization on the potential diversification benefit of a passive allocation to commodities. He quantifies financialization as the share of open interest in commodity futures contracts held by non-commercial traders per Commitments of Traders reports of the Commodity Futures Trading Commission. He investigates specifically the effects of financialization on: (1) roll return, the return from continually shifting from expiring to longer-term commodity futures contracts to maintain a position; and, (2) the correlations of commodity futures returns with those of stocks and bonds. Then, in a mean-variance optimization framework from the perspective of a U.S. investor, he examines how these effects alter the diversification benefit of adding a commodity futures position to stocks and bonds. Using monthly returns of index proxies for the broad U.S. stock market, U.S. government bonds and a broad set of commodity futures from the end of 1991 through 2012, he finds that:

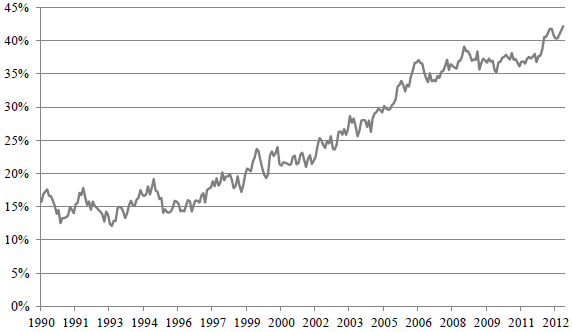

- During 1990 through 2012, the share of open interest in commodity futures contracts held by non-commercial traders increases from about 15% to 42% (see the first chart below).

- This surge in financialization accompanies:

- An expected commodity index roll return at the end of the sample period that is 0.38% per month lower than the sample period average.

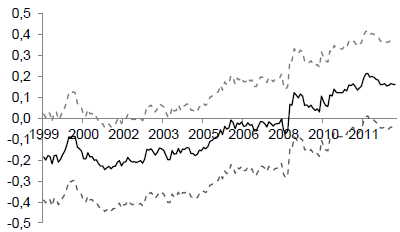

- A substantial increase in the correlation between equity and commodity futures returns (see the second chart below).

- The decrease in roll return and increase in return correlation render the mean-variance diversification benefit of a passive allocation to commodity futures insignificant.

The following chart, taken from the first paper above, illustrates the financialization of commodity futures as measured by the share of open interest held by non-commercial traders. This share increases from about 15% to 42% over the sample period, with an average level of about 25%.

The next chart, taken from the second paper above, tracks the five-year rolling correlation between monthly returns of U.S. stocks and commodity futures, along with statistical variability ranges. There is a substantial increase in correlation over the sample period that closely resembles the growth in financialization shown above.

In summary, evidence suggests that the power of a passive allocation to commodity futures to diversify a conventional stocks-bonds portfolio declines to insignificance over the past 20 years.

Cautions regarding findings include;

- The sample period is not long for subperiod analysis (for example, in terms of independent five-year correlation calculations).

- Mean-variance optimization generally assumes tame return distributions. To the extent that asset return distributions are wild (including that for commodity futures), the methodology breaks down.

- The use of indexes to calculate returns ignores costs of creating and maintaining tradable assets and therefore overstates returns. Overstatement may vary by asset class.