Do the relationships among returns for stocks and the most heavily traded commodities (gold and crude oil) consistently offer risk diversification? In their July 2013 paper entitled “Gold, Oil, and Stocks”, Jozef Baruník, Evzen Kocenda and Lukas Vacha analyze the return relationships among stocks ( the S&P 500 Index), gold and oil (light crude) over the past 26 years. Specifically, they test the degrees to which their prices: (1) co-move; (2) reliably lead one another; and, share any long-term relationships (such as ratios to which they revert). They seek robustness of findings by employing a variety of methods, data sampling frequencies and investment horizons. Using intraday and daily prices of the most active rolling futures contracts for the S&P 500 Index, gold and light crude oil during 1987 through 2012, they find that:

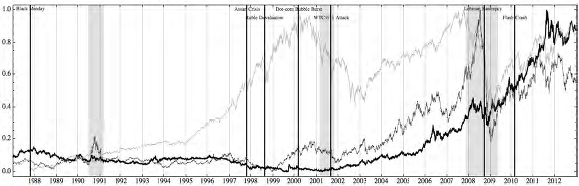

- Pairwise correlations between assets are low or even negative at first but later increase, with pronounced changes indicative of structural breaks (see the chart below). During and after the structural break associated with the 2008 financial crisis, correlations are very unstable and largely ineffective for risk diversification.

- Before (after) the financial crisis, correlations exhibit significant (negligible) differences at different investment horizons, further indicating loss of diversification power.

- None of the three asset classes reliably leads any other.

- The asset classes exhibit no long-term equilibrium relationships (such as pairwise ratios to which they revert).

The following chart, taken from the paper, tracks normalized prices of the most active futures contracts for the S&P 500 Index (light gray), gold (dark gray) and crude oil (black) over the sample period. Vertical gray areas indicate National Bureau of Economic Research (NBER) economic contractions, and vertical black lines indicate stock market crashes. Market crashes consist of Black Monday (October 19, 1987), the Asian crisis (October 27, 1997), Russian ruble devaluation (August 17, 1998), the dot-com bubble burst (March 10, 2000), the World Trade Center attacks (September 11, 2001), Lehman Brothers Holdings bankruptcy (September 15, 2008) and the Flash Crash (March 6, 2010). Such events may trigger structural breaks for asset return relationships.

In summary, evidence indicates that investors should reassess legacy beliefs about asset class diversification across stocks, gold and energy commodities.

Cautions regarding findings include:

- The effects of the 2008 financial crisis on return correlations may not persist.

- Increasing financialization of commodities (via exchange-traded funds and notes) may exacerbate the loss of diversification power.