Are other precious metals more effective than gold as safe havens from turmoil in stock and bond markets? In their September 2013 paper entitled “Time Variation in Precious Metal Safe Haven Status — Evidence from the USA”, Brian Lucey and Sile Li compare and contrast the effectiveness of four precious metals (gold, silver, platinum and palladium) as safe havens from sharp declines in U.S. stocks (the S&P 500 Index) and U.S. bonds (a 10-year U.S. Treasury note index). They define an asset as a safe haven from another if returns of the former exhibit zero or negative correlation with returns of the latter when the latter experiences a sharp drawdown. A safe haven is different from a hedge, which has zero or negative return correlation with another asset or portfolio on average. They calculate returns for precious metals based on a continually rolling position in nearest month futures. They calculate return correlations quarter by quarter and focus on the worst 5% of drawdowns in stocks or bonds. Using daily futures contract prices for gold, silver, platinum and palladium and daily returns for the stock and bond indexes from the first quarter of 1989 through the second quarter of 2013, they find that:

- Correlations between precious metal returns and U.S. stock and bond index returns are consistent until 1998, but not thereafter.

- There are times when gold is a safe haven but other metals are not. There are also times when silver, platinum and palladium are safe havens but gold is not.

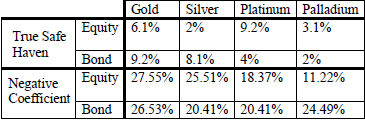

- Overall (see the table below):

- Gold is the most broadly effective safe haven from the worst 5% of S&P 500 Index drawdowns, followed closely by silver and more distantly by platinum and then palladium.

- Gold is the most broadly effective safe haven from the worst 5% of U.S. Treasury note index drawdowns, followed closely by palladium and then by the equally reliable silver and platinum.

The following table, adapted from the paper, summarizes likelihoods that gold, silver, platinum and palladium function separately as statistically significant safe havens (True Safe Haven) and possible safe havens (Negative Coefficient) for the 5% worst drawdowns in either the S&P 500 Index (Equity) or a U.S. Treasury note index (Bond) during 1989 through mid-2013. Since safe haven behaviors of the four metals are non-overlapping, holding a mix of the metals broadens (but may weaken) safe haven coverage over time.

In summary, evidence suggests that silver, platinum and palladium are useful as safe havens (but mostly less reliably than gold) and that holding a portfolio of precious metals expands safe haven coverage over time.

Cautions regarding findings include:

- The study’s approach to safe haven analysis does not model portfolio-level performance with and without a safe haven. It is not obvious that maintaining positions in safe haven assets enhances long-term portfolio performance.

- The study does not investigate safe haven effectiveness by type of stock and bond market crisis.