Are there opportunities to trade S&P 500 Index additions in the current market environment? In her May 2017 paper entitled “The Diminished Effect of Index Rebalances”, Konstantina Kappou examines returns for S&P 500 Index additions before and after the 2008 financial crisis. She focuses on additions because deletions generally involve confounding information such as restructuring, bankruptcy or merger. Current index management practices are to announce changes after market hours about five days in advance (announcement date – AD) and to implement changes at the specified close (event date – ED). She investigates returns during an event window from 15 trading days before AD through 252 trading days after ED. She calculates abnormal returns as differences between returns for added stocks and contemporaneous market returns. She considers 276 index additions during January 2002 through November 2013, with October 2008 separately pre-crisis from post-crisis. She excludes 48 of the additions due to lack of data or confounding information. Using daily returns for the remaining 228 S&P 500 Index additions during the specified sample period, she finds that:

- Average daily abnormal returns of S&P 500 Index additions before AD are generally insignificant, indicating that the market does not anticipate announcements.

- Regarding average abnormal returns for AD and AD+1:

- Close-to-close is a highly significant 3.01%.

- Close-to-open (largely unexploitable) is 3.23%.

- Open-to-close (exploitable) is a statistically insignificant -0.22%.

- For the post-crisis subperiod, close-to-open is 3.25% and open-to-close is a significantly negative -0.62%.

- Between AD+1 and ED, average cumulative abnormal returns are insignificantly positive (0.23%) for the full sample, significantly positive for the pre-crisis subperiod (0.87%) and insignificantly negative (-0.57%) for the post-crisis subperiod.

- On ED, average cumulative abnormal returns are significantly positive (0.53%) for the full sample, significantly positive for the pre-crisis subperiod (0.96%) and insignificantly negative (-0.10%) for the post-crisis subperiod.

- During the month after ED, average abnormal daily returns are nearly all negative, fully offsetting the large price boost from announcement.

- Over the full sample, adding AD-inflated stocks to the S&P 500 Index adds less than 0.10% per year to the index (0.12% pre-crisis and 0.05% post-crisis).

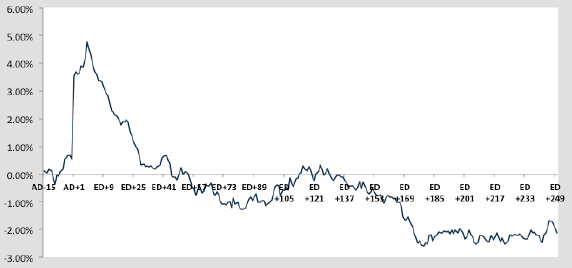

The following chart, taken from the paper, tracks average cumulative abnormal returns of stocks added to the S&P 500 Index from 15 trading days before AD through 252 trading days after AD over the full sample period. Results indicate:

- A large gap up between after-hours announcement and the next open.

- Modest additional gains between AD and ED (absent since the financial crisis).

- Complete reversal of the AD-ED gains over the following month.

In summary, evidence indicates no exploitable abnormal returns between announcement and event dates for stocks added to the S&P 500 Index since the financial crisis, but subsequent reversal of the announcement gap up may be tradable.

Cautions regarding findings include:

- The sample period/subperiods are not long in terms of variety of market conditions.

- Results do not account for any costs of trading, which would reduce returns.

- Holding cash in reserve to exploit index additions as announced would affect overall portfolio performance.