Does choice of multi-asset portfolio rebalance date(s) materially affect performance? In their October 2018 paper entitled “Rebalance Timing Luck: The Difference Between Hired and Fired”, Corey Hoffstein, Justin Sibears and Nathan Faber investigate effects of varying portfolio rebalance date on performance. Specifically, they quantify noise (luck) from varying annual rebalance date for a 60% S&P 500 Index-40% 5-year constant maturity U.S. Treasury note (60-40) U.S. market portfolio. Using monthly total returns for these two assets during January 1922 through June 2018, they find that:

- Rebalance timing significantly affects performance, and this effect is not mean reverting. The 60-40 portfolio specified above, rebalanced annually, has:

- Gross annualized return 8.27% (8.49%) over the full sample period if rebalanced at the end of October (May). May rebalancing generates over 20% greater terminal wealth than October rebalancing.

- 7% greater return during February 2009 to February 2010 if rebalanced at the end of February rather than August.

- Has 0.36% standard deviation of 12-month rolling returns over the full sample period for 12 variations of the portfolio, each rebalanced at the end of a different calendar month (a measure of rebalance timing luck).

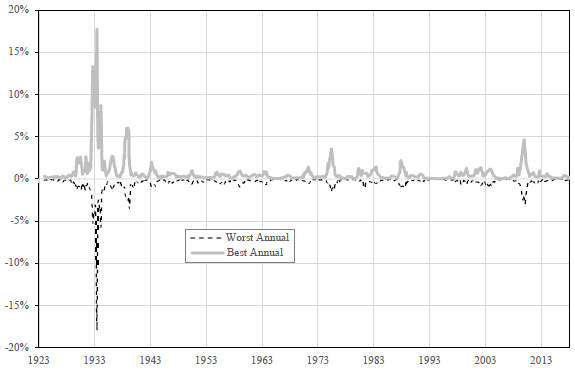

- Has rebalance timing luck that varies considerably over time, with subperiods of stability punctuated by explosive deviations (see the chart below).

- Investors can suppress rebalance timing luck by holding equally weighted portfolios with staggered rebalancing dates. N such portfolios suppress this noise by 1/N.

The following chart, taken from the paper, compares rolling 12-month returns for two 60-40 portfolios as specified above with the best and the worst end-of-month rebalance dates each year relative to the average for 12 portfolios rebalanced at the end of all 12 respective months. Results show that rebalance timing risk is more a tail effect than a consistent risk.

In summary, evidence indicates that choice of portfolio rebalancing schedule carries some performance risk and that holding multiple portfolios with different rebalancing schedules suppresses this risk.

Cautions regarding findings include:

- Examples employ indexes, which do not account for the costs and practices associated with liquid tracking funds. Such costs and practices could affect findings.

- Holding multiple portfolios with different rebalancing dates may drive materially greater trading frictions for some investors. Per the authors: “…increased rebalance frequency does imply a potential increase in the number of transactions, which can increase total explicit trading costs. However, those transactions are likely to be smaller in magnitude, thereby reducing expected market impact. Ultimately, the actual costs will largely be strategy dependent, and beyond the scope of this article.”

For another perspective from a similar analysis, see “Optimal Rebalancing Frequency/Months?” See also the more granular and complicated: