Is the Commodity Trading Advisor (CTA) segment so crowded that flows of funds into or out of them around the turn of the month materially affect prices? In the October 2014 version of his paper entitled “The MOM-TOM Effect: Detecting the Market Impact of CTA Trading”, Otto Van Hemert explores whether the trend-following or time series momentum (MOM) style employed by many CTAs is so crowded that inflows around the turn of the month (TOM) affect momentum strategy returns. He notes that most CTA-managed funds offer monthly liquidity, thereby concentrating flows at month ends. He defines TOM as the last two days of a month plus the first day of the next month. He tests whether there is an above average return for MOM strategies during TOM (MOM-TOM effect). He uses the Newedge CTA Index (an equal-weighted aggregate of the largest CTAs open to new investments) and the Newedge Trend Index (an equal-weighted aggregate of the MOM style CTAs that are open to new investments) as proxies for the overall market and the MOM style, respectively. Using daily returns for these two indexes during January 2000 through March 2014, he finds that:

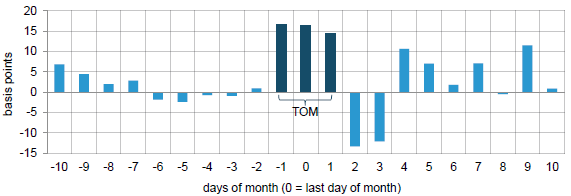

- Newedge Trend Index returns are highest during TOM (see the first chart below).

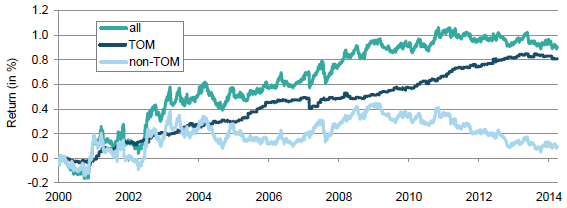

- This MOM-TOM effect on the Newedge Trend Index is so strong that 90% of cumulative returns since 2000 occur during the three TOM days (see the second chart below).

- A commodity futures trading strategy designed to track the Newedge Trend Index also exhibits a strong MOM-TOM effect.

- The MOM-TOM effect is also evident for the Newedge CTA Index, indicative of widespread use of trend-following among CTAs.

- Three additional findings support belief that trend-followers move the market during TOM.

- The MOM-TOM effect partially reverses immediately after TOM (see again the first chart below).

- The MOM-TOM effect is much stronger for illiquid commodity futures, which are likely more sensitive to price pressure than liquid commodities.

- A TOM effect in passive long positions does not fully explain the MOM-TOM effect.

The following chart, taken from the paper, shows average returns for the Newedge Trend Index from ten days before (-10) to tend days after (10) the last trading day of the month over the entire sample period. Day 0 is the last trading day of the month. Returns are in basis points (10 = 0.1%). The chart shows that trend-following returns are on average highest during TOM and lowest during the two trading days after TOM. Results suggest that TOM net inflows to CTA-managed funds exert measurable price pressure, that some CTAs anticipate this effect and that some CTAs harvest the effect after TOM.

The next chart, also from the paper, compares cumulative returns of the Newedge Trend Index using all days (top line), TOM days only (dark blue line) and non-TOM days only (light blue line) over the sample period. At the end of the sample period, 90% of overall index returns accrue from the three TOM days of each month.

Very recently (since mid -2013), returns on TOM days have been negative, consistent with net outflows from CTA-managed funds. Such outflows reverse the MOM-TOM effect by forcing trend-following CTAs to liquidate positions to return funds to investors.

In summary, evidence indicates that trend-following CTAs move commodity futures markets at the turn of the month when they process net inflows or net outflows.

The best opportunities for exploitation may involve the least liquid commodity futures.

Cautions regarding findings include:

- In percentage terms, the MOM-TOM effect is not large.

- Reported return effects are gross, not net. Trading in and out of futures to exploit the MOM-TOM effect would incur trading frictions and reduce performance.

- Other obstacles to exploiting the MOM-TOM effect efficiently include:

- Illiquidity of CTA-managed funds essentially prevents exploitation via such funds.

- Full exploitation would require mimicking and front-running the long and short positions of trend-following CTAs.

See also “Turn-of-the-Month Effect Persistence and Robustness” for the U.S. stock market.