Does the U.S. stock market exhibit predictable return and volatility patterns during the trading day? To investigate, we analyze one-minute prices for SPDR S&P 500 (SPY) over two recent years. Specifically, we calculate average cumulative return, average returns for 15-minute intervals and average standard deviation of one-minute returns during 15-minute intervals over the trading day during each of 2007 (bullish year) and 2008 (bearish year). Using a sample of SPY one-minute prices for 9:30-16:15 spanning 2007-2008 (over 203,000 observations), we find that:

There are two data quality issues:

- The daily opening and closing prices in the sample often deviate slightly from those for (unadjusted) SPY at Yahoo!Finance. Tick selection may be the reason, and the mismatches are probably not important.

- There are some prices missing in the sample. We exclude from averages any returns associated with these missing data. There are enough prices missing for 7/22/08 that we exclude the entire day. For 12/17/08-12/31/08, there are no prices after 16:00.

We exclude from consideration shortened trading days (7/3/07, 11/23/07, 12/24/07, 7/3/08, 11/28/08 and 12/24/08), since early closes would likely shift any patterns.

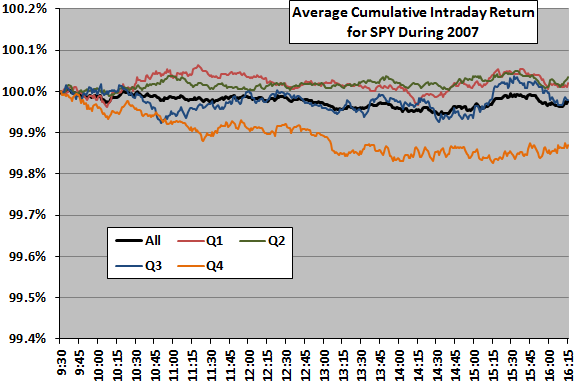

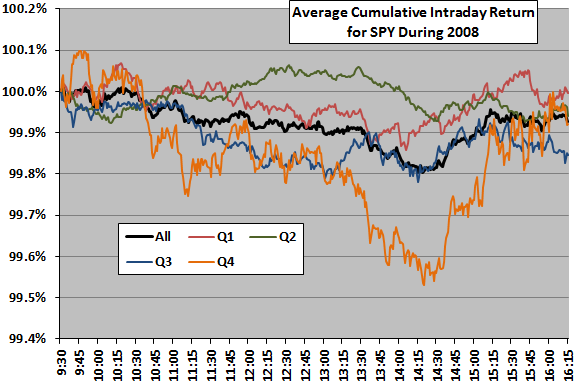

The following two charts show the average SPY intraday cumulative returns based on one-minute prices, overall and by quarter, for 2007 (upper chart) and 2008 (lower chart). The charts use the same scale to facilitate comparison, emphasizing that intraday behavior is much more volatile during 2008 than 2007. Notable points are:

- There may be a tendency for the stock market to decline in early afternoon and subsequently rebound.

- However, differences among quarters undermine belief in a reliable pattern.

- Average returns associated with any patterns, even those for volatile 2008, are likely too small to exploit on a net basis as a standalone strategy. When trading frequently for other reasons, attending to intraday tendencies may be advantageous (for example, scheduling buys for mid-afternoon).

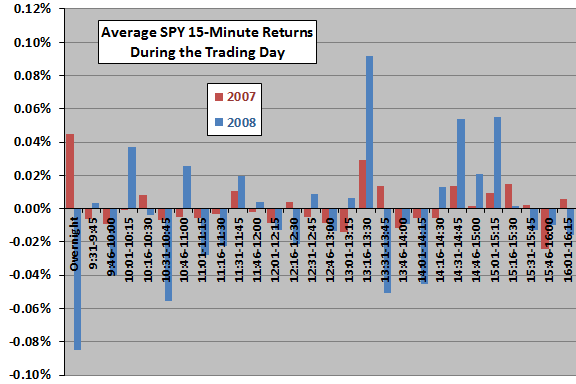

For another perspective, we look at consecutive 15-minute returns.

The next chart compares average overnight returns and average intraday 15-minute returns for SPY during 2007 and 2008. There is no compelling pattern, but there is perhaps some indication of alternating strength and weakness in the afternoon.

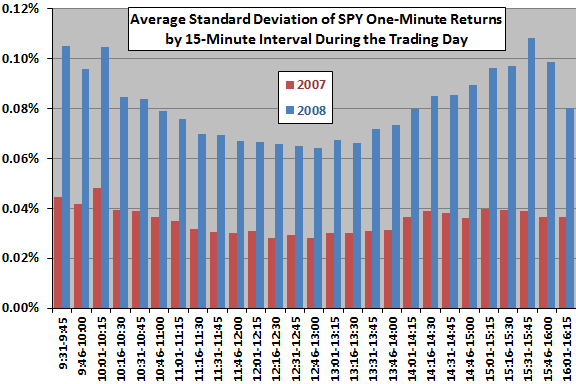

Might there be a stronger case for a pattern in volatility during the day based on lower market liquidity at the open and the close?

The final chart compares average standard deviation of SPY one-minute returns by 15-minute intraday intervals for 2007 and 2008. While 2008 is much more volatile than 2007, both years exhibit relatively high volatility near the open and close and low volatility in the middle of the day. This pattern suggests that frequent traders may want to schedule option buys (sells) during the middle (beginning and end) of the trading day when the short-term realized volatility may affect implied volatility and therefore option prices. It also suggests that more aggressive limit orders may be appropriate at the beginning and end of the day.

In summary, evidence from two recent years suggests a slight tendency for the U.S. stock market to be a little weak during mid-afternoon and some tendency for volatility to be lower during the middle of the day than at the beginning or end.

Cautions regarding findings include:

- As noted, intraday return patterns are not very reliable, and average return variations are very small compared to probable costs of exploitation.

- Patterns for other years may be different.