Does seasonality usefully combine with trend following for timing asset markets? In his January 2016 paper entitled “Multi-Asset Seasonality and Trend-Following Strategies”, Nick Baltas examines seasonal patterns (based on same calendar month over the past ten years) for four asset classes: commodities, government bonds, currency exchange rates and country equity markets. He then tests whether identified seasonal patterns enhance a simple trend-following strategy that is long (short) the inverse volatility-weighted assets within a class that have positive (negative) excess returns over the past 12 months. Specifically, he closes any long (short) trend positions in the bottom (top) fifth of seasonality rankings. To assess net performance, he considers trading frictions ranging from 0.05% to 0.25%. Using spot and front futures return data for 19 commodity price indexes and spot return data for 16 10-year government bonds, 10 currency exchange rates and 18 country equity total return indexes as available through December 2014, he finds that:

- Regression analyses of spot returns commencing January 1975 for equities, July 1991 for commodities, July 1994 for government bonds and January 1991 for currency exchange rates indicate that:

- Commodities and (less so) equities exhibit significant seasonality.

- Government bonds and currency exchange rates do not.

- A strategy that is each month long (short) the fifth of assets with the largest (smallest) past average returns during the same calendar month over the past ten years:

- Generates about 4% average gross annual return and 0.49 gross annual Sharpe ratio for commodity futures starting in 1992.

- Generates about 3% average gross annual return and 0.45 gross annual Sharpe ratio for spot equity indexes starting in 1980.

- Has, however, high turnover that likely prevents direct exploitation of seasonality patterns.

- Is effectively market neutral and uncorrelated with value and momentum strategies.

- The trend-following strategy with seasonality overlay as described above beats the basic trend-following strategy on a gross basis:

- Gross annual Sharpe ratio increases from 0.71 to 0.81 for commodity futures and from 0.66 to 0.71 for spot equity indexes. For commodities (equities) the improvement in Sharpe ratio disappears as trading frictions increase to about 0.25% (0.20%).

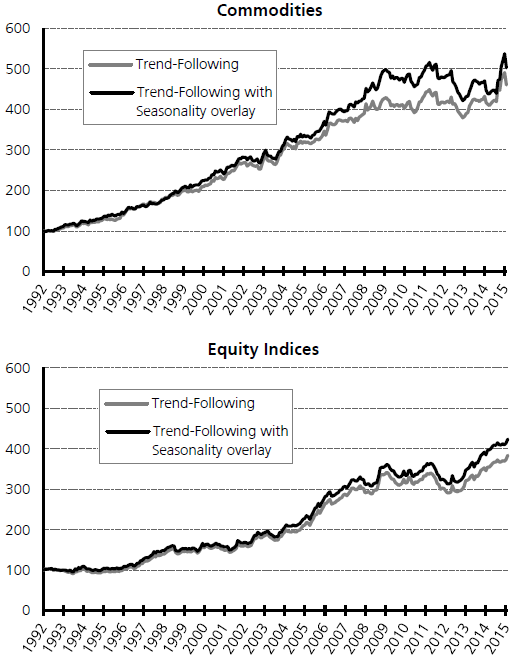

- For a version with monthly leverage equal to the ratio of running realized volatility of the basic trend-following strategy to a volatility target (7%), gross annual Sharpe ratio increases from 0.91 to 0.98 for commodity futures and from 0.81 to 0.85 for spot equity indexes (see the charts below). For commodities (equities) the improvement in Sharpe ratio disappears as trading frictions increase to about 0.20% (0.15%).

The following charts, taken from the paper, illustrate gross enhancement of the dynamic leveraged trend-following strategy specified with target volatility 7% when augmented by seasonality overlay as applied to commodity futures (upper chart) and spot equity indexes (lower chart). For commodities (equities), gross annual Sharpe ratio increases from 0.91 to 0.98 (0.81 to 0.85).

In summary, evidence indicates that investors may be able to enhance commodity futures and equity index trend following strategies with seasonal overlays that close some positions.

Cautions regarding findings include:

- Samples are short in terms of the number of independent 10-year intervals used to measure seasonality, elevating effects of non-normality in distributions and data snooping bias.

- In general, the use of indexes ignores the costs of maintaining liquid tracking funds, thereby overstating expectations. Some indexes and tracking funds may respond differently to technical signals.

- As noted in the paper, spot returns and future returns differ materially for commodities, undermining the realism of analyses using spot returns.

- Testing multiple versions of a strategy on multiple data sets introduces snooping bias, such that the best-performing combination overstates expectations.